“Fake News” Caused the Bitcoin Dump – Why We’re Long on Altcoins

Breaking Bitcoin Market Update

September 07, 2022

Bitcoin has consolidated since it's drop yesterday. As we continue our analysis, it seems likely that Binance's announcement of "consolidating stablecoin pairings" was the catalyst that sent fearful traders into dumping their positions. Unfortunately, as we've consistently stated, current demand levels for Bitcoin are barely unable to keep Bitcoin's current price propped up, so any forced selling events (selling catalysts) will be met with significant price dumps.

We note that the Relative Strength Index (RSI) applied to Bitcoin shows faint, but visible, Regular Bullish Divergence. Bullish divergence occurs when price makes a lower low, however our momentum oscillator makes a higher low. This is often a key sign of seller weakness, and a consistently successful trading signal to buy.

I have posted the chart showing the divergence, as well as displaying our Stop & Target Indicator: Quadrigo ATR for those who wish to follow along with the trading signal.

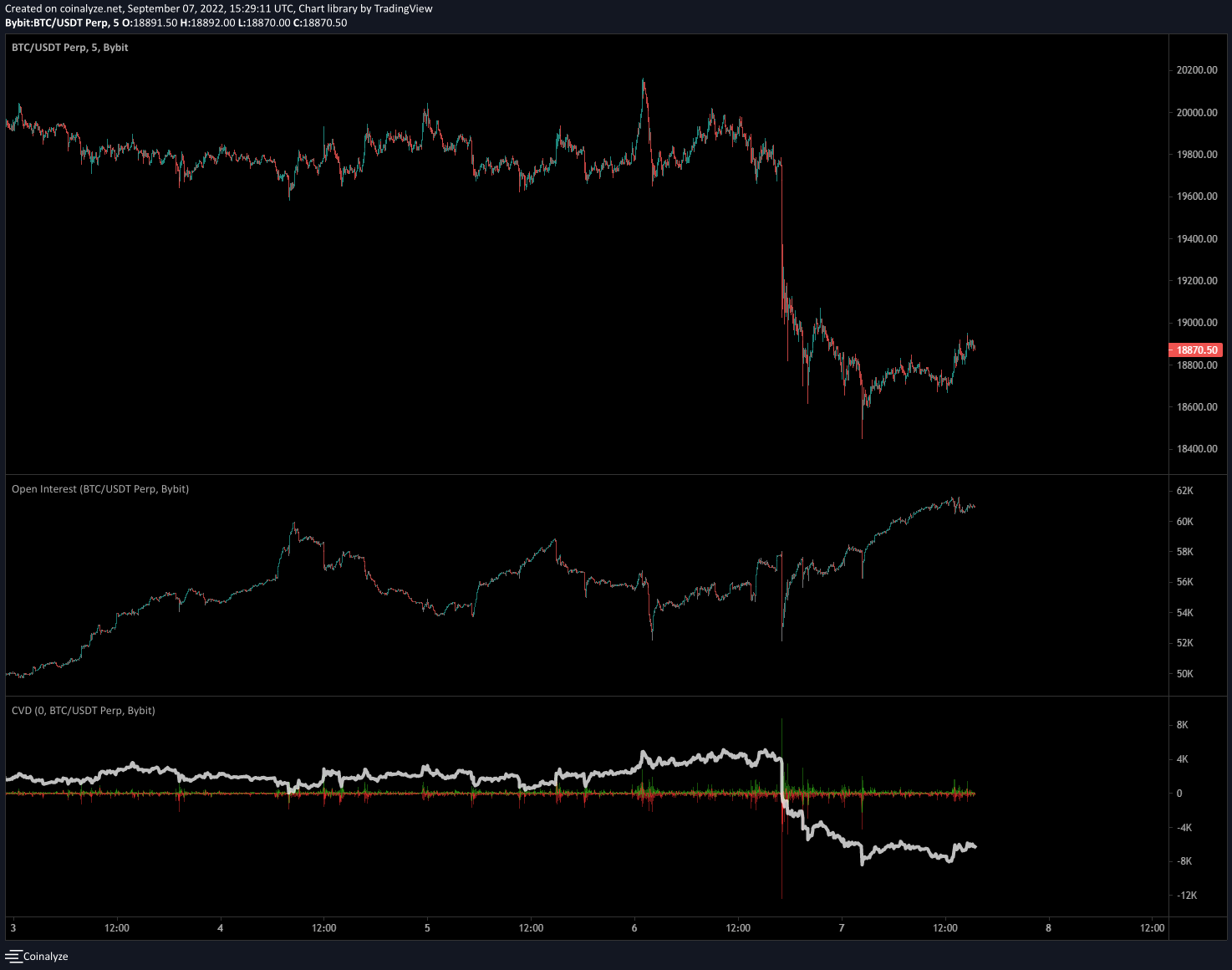

Looking at lower time frames, we can see that Open Interest is rising at a rapid pace on Bitcoin. Rising Open Interest indicates that traders are putting on new positions, and we can expect directional movement and momentum once a significant amount of traders have positioned themselves for the move. Looking at Cumulative Volume Delta to get an idea whether buyers or sellers are in control, we can see that CVD was rising prior to the dump, and the sharp drop in Open Interest after Bitcoin fell off a cliff indicates that the majority of traders were on the wrong side of the market.

The drop in Open Interest shows that many positions got closed out forcefully, looking at liquidation levels we can see that a lot of longs got wiped out in that dump. Therefore, seeing how traders are positioned will not always net you a winning trade. However, looking at and understanding how to interpret market data is the first step on the sign to increasing your winners and reducing your losers.

CVD has continued to drop as Bitcoin's price has, however we do see an uptick in buying pressure. We will have to watch this metric closely today, but it's possible that the bottom is in and traders are positioning themselves to the long side, giving strength the the higher time frame bullish divergence pointed out above.

Pathways to Profit Trading Strategy Summary

Our PTP Trading Strategy recommends holding one's short position open on Bitcoin at this time. Our system triggered a short sell signal on Bitcoin on August 18th, with all four of our indicators coming into alignment. There is no exit signal at this time, with Waddah Attar Explosion increasing in negative delta, Parallox and Mynx remaining in bearish territory, and price remaining below the Daily Base Line.

Although we have picked up contrary long exposure, the primary short position should remain open. 50% profits should be taken/have already been taken, and your stop loss should be updated to your entry price.

Altcoins of Interest

Today we will be looking at some pumping altcoins to see where the opportunity lies. Today we will summarize Adventure Gold (AGLD), Helium (HNT), and Stargate Finance (STG).

Let's begin with AGLD.

From TradingView, we can see that AGLD has successfully closed above the Daily Base Line. It also made this movement with a significant spike in exchange volume. The Relative Strength Index has surged above 50, and is now in bullish territory.

Applying our PTP indicators, we can also see that we have all the signs of a primary long signal. Mynx above zero, Waddah Attar Explosion showing positive delta and a rising explosion level, and Parallox above zero. Again, all of this in combination with price closing above the Daily Base Line.

The only mitigating factor here for me is that Mynx has been pushed close to overbought territory. This makes me desire to reduce my risk on this trade by half.

Turning to Santiment, we see mitigating factors. That is, we see that price has been moving up, put in a potential top, and corresponding with that action we have a large spike in Daily Active Addresses, On-Chain Volume, and Exchange Volume. Unfortunately, this is usually the tale-tell signs of a price top, as earlier investors take advantage of the exit liquidity and sell into market strength.

Now, this is my bias due to the current market conditions. However, if AGLD can sustain it's Daily Active Addresses count and Exchange Volume, then it can be a signal of continued strength and just a sign of how bullish things really are. Due to these reasons, I will avoid entering into any positions on AGLD right now, and wait to see how price reacts to being above the Daily Base Line.

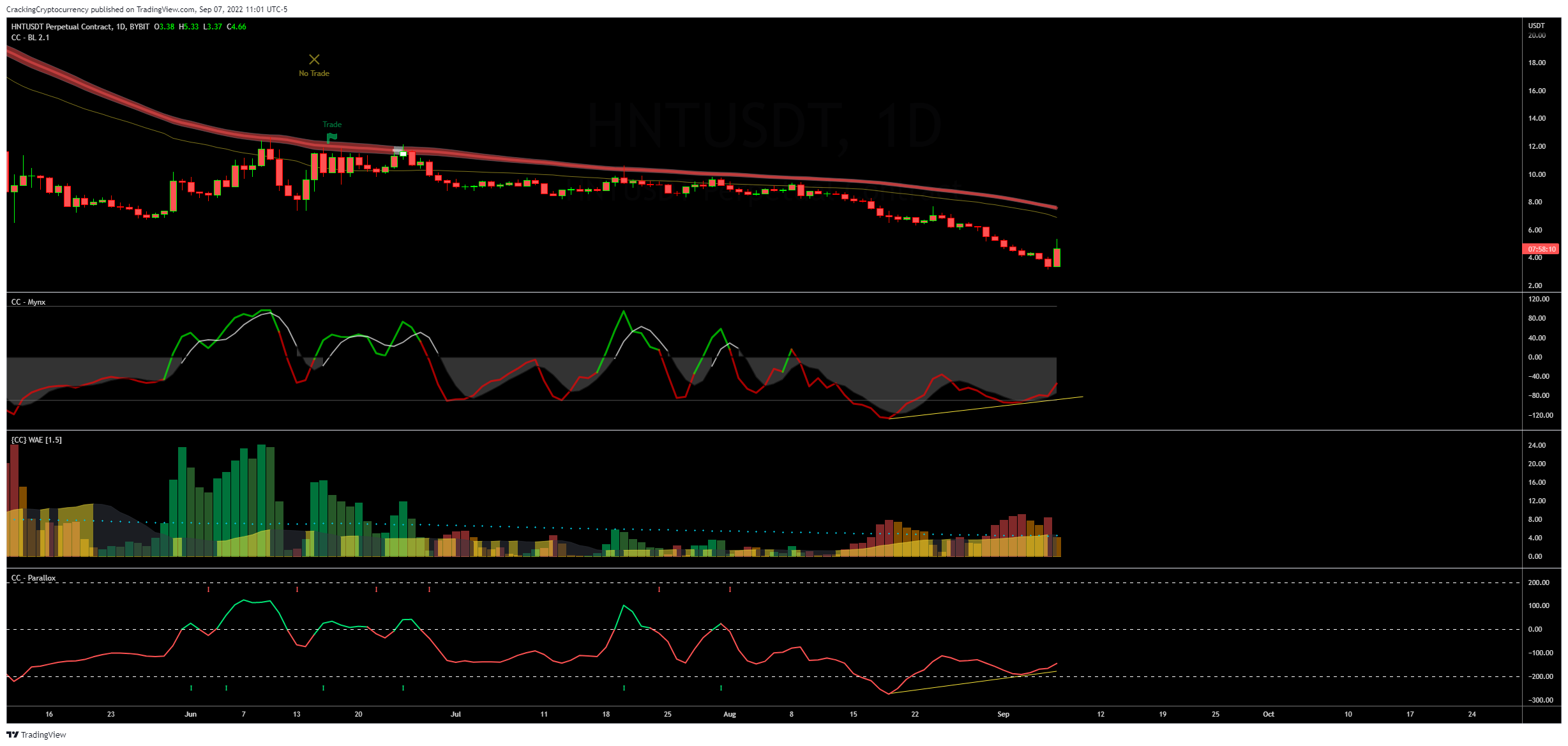

Let's continue with Helium (HNT).

Loading up our PTP indicators first, we can see that HNT tells a different story than AGLD. Unlike AGLD, which had been increasing in price prior to volume and momentum coming in, we can see that HNT has been in a price decline. Not only that, but we have clear Regular Bullish Divergence from Mynx AND Parallox, giving us quite a strong buying indication.

Unfortunately, Santiment does not have data for DAA or TV, so we are simply left with confirmation that volume is indeed skyrocketing on this asset.

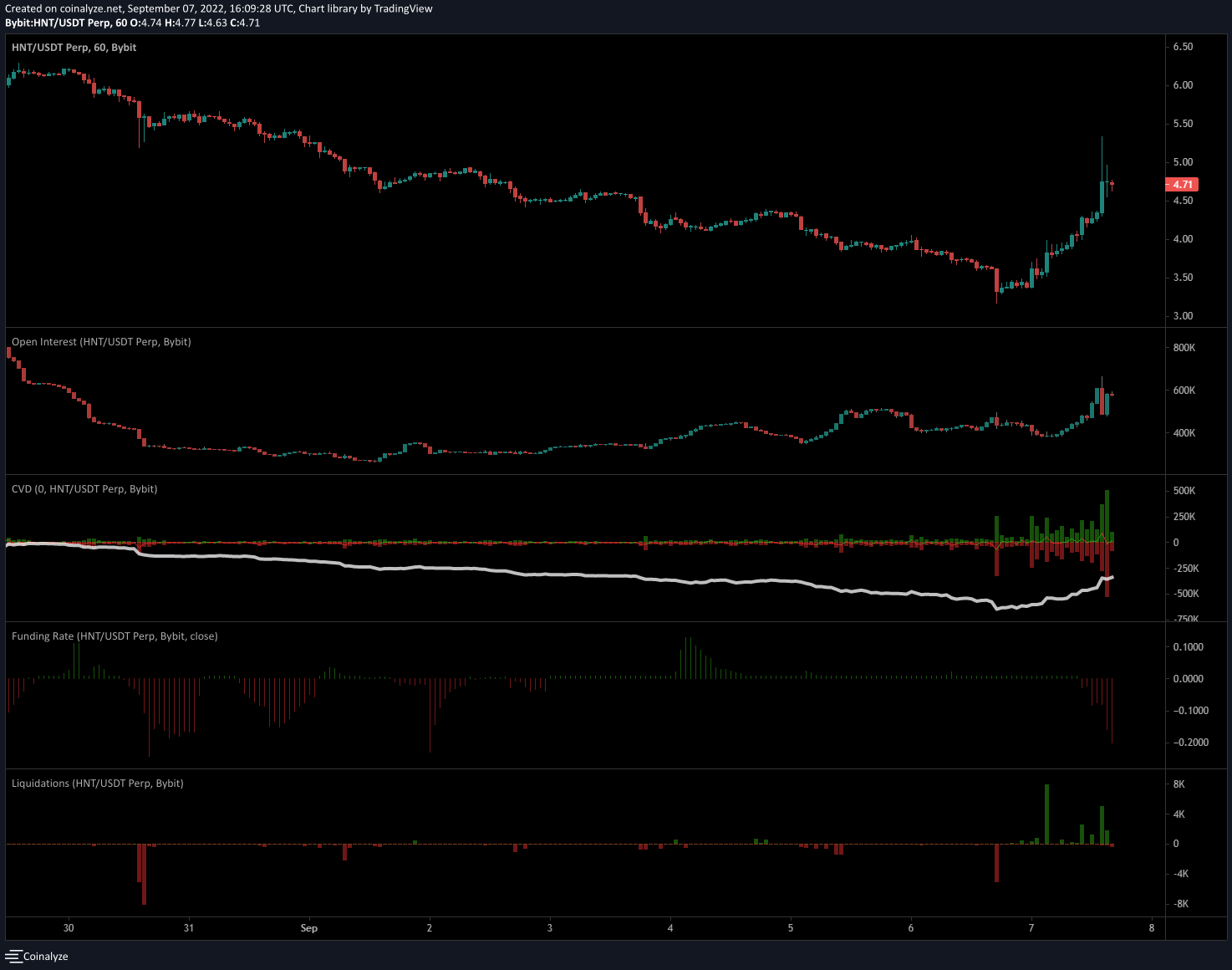

Turning to LTF data, we can see that Open Interest remains high. Although there was a drop in OI on this latest pump, you can see it replenished immediately with new traders taking up the long seat. CVD is also on the rise, indicating that for now, buyers are still in charge. There have been a lot of short liquidations, and funding is negative, so more leverage is being used to the short side.

All this indicates that if buyers remain in control, HNT can continue to pump quite a bit into a short squeeze as it catches short traders off sides and they're forced to buy to close their positions out, exacerbating the effects of the pump. One to watch very closely.

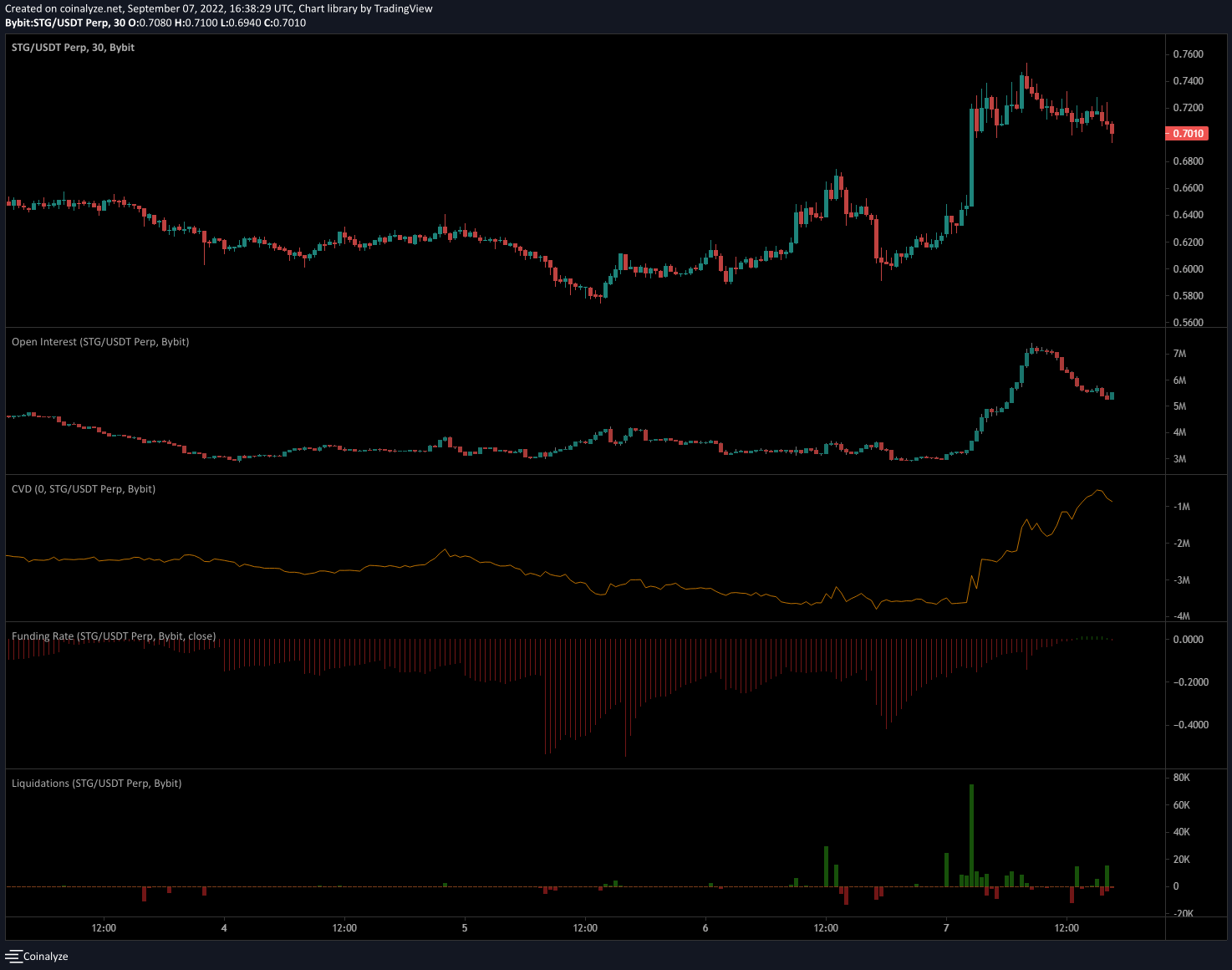

Finally, Stargate Finance (STG).

There is not enough data to analyze STG on the daily timeframe, so we've switched to the four hour time frame for clarity. Here we can see that STG has closed above the Base Line, and the rest of our PTP indicators show bullish momentum as well. STG is currently pulling back and holding the DBL, so we turn to LTF analysis to see if there's a buying opportunity.

First, from Santiment we see something that I like. We can see that STG did indeed have a spike in DAA as well as on-chain volume prior to the pump, but we have yet to see a similar spike here at a price high. This indicates to me that potentially, the pump is not over, because large players have not yet begun moving to take advantage of exit liquidity on-chain.

Finally, we can see from that CVD is on the rise, indicating buyers are in charge. Open Interest is dropping, so I would like to wait until I see that metric begin ticking back up again, showcasing that new traders are entering the arena once again. The most powerful signal here is that Funding has peaked to the downside and crept back up into the positive, indciating that new traders are net long. STG is on my active watchlist for today.

Summary

It appears that yesterday's dump was likely caused due to misinformation about Binance's stablecoin announcement, an announcement I will be covering and clarifying on my Twitter account (make sure to follow me!). Today, we see buyers stepping in and focusing mainly on altcoins of interest, which after careful analysis appear to still have plenty of steam left.

There are lots of opportunities out there, and being net long isn't looking too bad for today. Of course, our advanced trading strategies are recommending caution and of course our overall hedge position on Bitcoin does remain intact, however paying attention and being disciplined will allow you to catch opportunities such as I've pointed out.

Did you know we teach individuals to trade like professionals? With access to the Premium Trading Group, you will receive daily insights, market analysis, trading signals, portfolio recommendations, access to our Premium Indicator Suite, Online Trading Academy, and Private Discord Community where you will meet like-minded and passionate crypto investors and traders. Join the revolution overtaking the cryptocurrency markets today!

![Adventure Gold (AGLD) [10.58.47, 07 Sep, 2022] Adventure Gold (AGLD) [10.58.47, 07 Sep, 2022]](https://crackingcryptocurrency.com/wp-content/uploads/2022/09/Adventure-Gold-AGLD-10.58.47-07-Sep-2022.png)

![Helium (HNT) [11.06.34, 07 Sep, 2022] Helium (HNT) [11.06.34, 07 Sep, 2022]](https://crackingcryptocurrency.com/wp-content/uploads/2022/09/Helium-HNT-11.06.34-07-Sep-2022.png)

![Stargate Finance (STG) [11.29.31, 07 Sep, 2022] Stargate Finance (STG) [11.29.31, 07 Sep, 2022]](https://crackingcryptocurrency.com/wp-content/uploads/2022/09/Stargate-Finance-STG-11.29.31-07-Sep-2022.png)