Markets Respond Positively – FOMC Hanging Overhead

Happy Tuesday Fam!

The markets are having a relatively positive day. The overall market cap has grown 2.5% to sit at $0.975 Trillion. Bitcoin is up nearly 3%, Ethereum is up nearly 4%, and most altcoins are printing modest single digit gains. Notable outliers are Helium (HNT) up 11%, Stellar Lumens (XLM) up 8%, and Ripple (XRP) up 6%.

Traditional markets are up today as well, with VOO, DIA, and QQQ all posting sub 1% gains. Major stocks are up today as well.

Bitcoin Dominance sits at 37.93% and Ethereum Dominance at 16.74%.

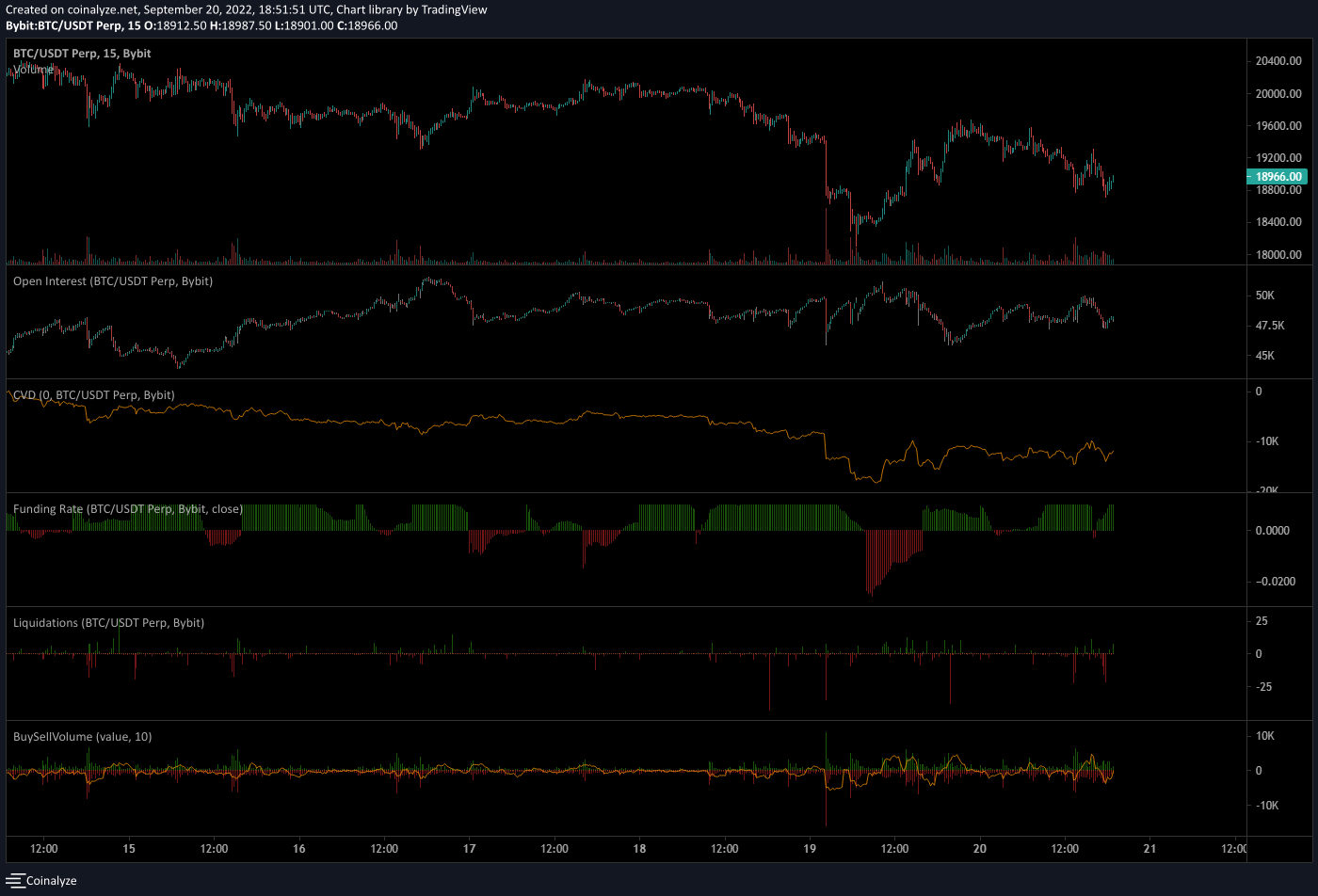

Bitcoin Analysis

Following yesterday's breakdown of Bitcoin's price below support, the markets as stated earlier have responded well today, particularly Bitcoin. Helped by the positive movement in stocks, Bitcoin picked up a lot of Open Interest in this low, indicating that there is a good amount of demand here.

Since we are the range lows, and the current market regime is one of mean reversion, the strategy we should look to employ here is to be long. We are wary of downside price movement following the FOMC meeting tomorrow, but we are expecting positive price movement at least leading up to that event. Bitcoin is currently establishing a higher low at yesterday's Point of Control, a positive sign.

We recommend a long position on Bitcoin at these price levels, utilizing the current swing low as your stop loss. Potential upside targets are the one hour 200-SMA as well as today's Point of Control, 19.750 and 19250 respectively.

Altcoin Analysis

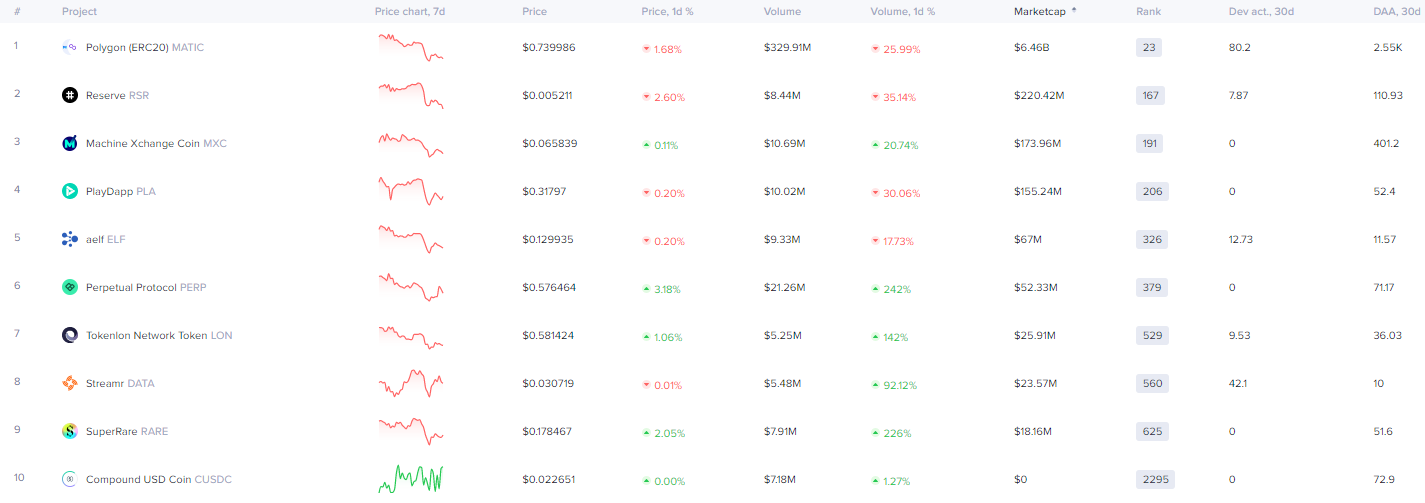

Open Interest Increases

Here we track altcoins on ByBit's Perpetual Swap Markets for tokens that have significantly increased in Open Interest. Such a rise indicates significant positioning by traders and likely profitable opportunities.

Our system is biased short on XRP and biased long on INJ. We took no other OI positions today.

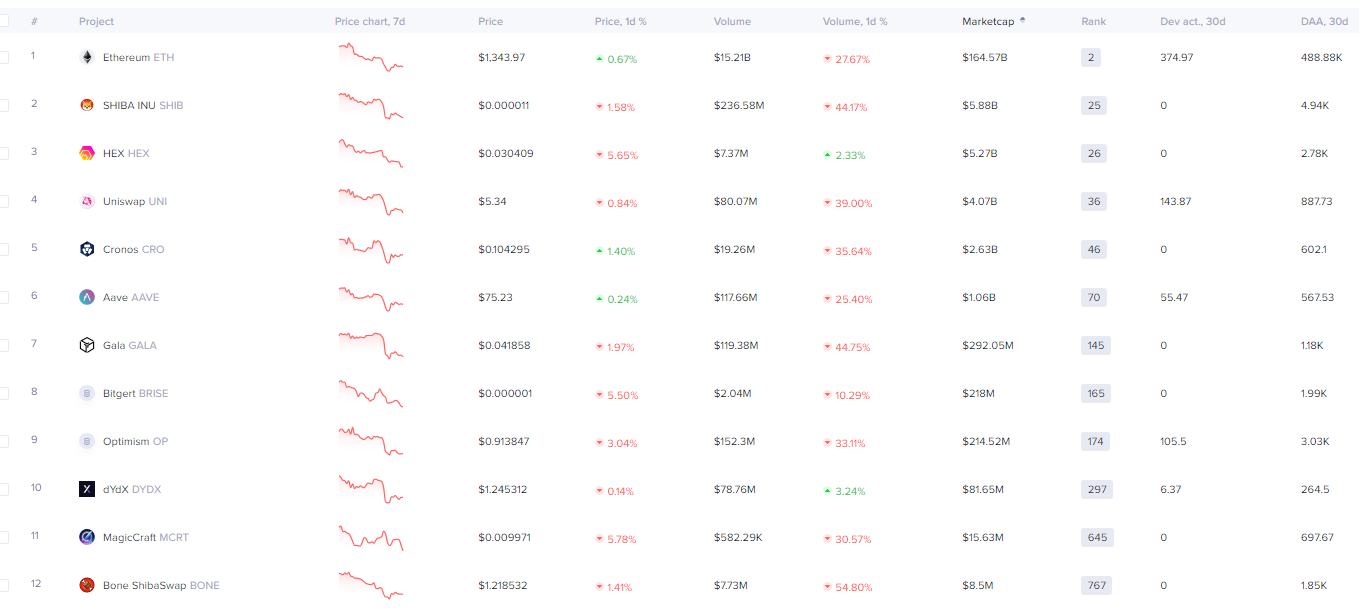

Strong and Oversold

Here I track the top coins that are potential buys. This is evaluated through Santiment on the basis of having MVRV Ratios that are oversold, along with strong on-chain activity. This generally indicates accumulation and warrants further investigation.

Our strategies are biased long on HEX and Bone ShibaSwap.

Exchange Inflow Anomalies

Here I track the top coins that are potential sells. This is evaluated through Santiment on the basis of significant exchange inflows deviating from the norm. This indicates a large rush of coin deposits, which is generally an indication of investor sentiment to sell.

Traditional Markets Update

A new section from a long-time member of our community, Paul the Person. He has focused on Treasury Yields, Bonds, and Macroeconomics during the bear market. We are proud to provide his analysis as part of our daily content.

Historically with the available data on TradingView (inconveniently cuts off at 2008), we see two quarters (as each candle is 3 months) where the 1 year yield has inverted the 10 year yield.

The first time in the recent decade that this occurred, over the next two quarters, we saw a 35.63% decline in the Spy with a quick recovery.

The second quarter we've seen this is, funny enough, the same quarter (July quarter), 3 years later, where we are right now. We still have a little less than two weeks remaining in the quarter, so we have not officially closed out the quarter yet with the 1 year inverting the 10 year.

This time, we are ALSO seeing the 1 year yield invert the 30 year yield. We have NEVER closed out a quarter like this before in the recent decade.

The bond market is telling us that this next dip, if history rhymes, should be GREATER than 35.63% because of the greater severity of the 1 year yield inversion.

We have already fallen 24.54%, which leaves us another 11.09% to repeat the 35.63% previous decline. The severity of the 1 year ALSO crossing the 30 year yield as well, which has not happened in the recent decade, increases the probability that the crash will be even greater than 35.63%, as that was the last fall, and the 1 year had not even closed out the quarter inverting the 30 year at that time.

Hope this post was insightful!!

Summary:

Although the albatross of a price breakdown and further capitulation remains ever present, markets are responding positively. We expect upwards price pressure heading into the FOMC meeting, and we will reevaluate after an analysis of market sentiment following the announcement.

Did you know we teach individuals to trade like professionals? With access to the Premium Trading Group, you will receive daily insights, market analysis, trading signals, portfolio recommendations, access to our Premium Indicator Suite, Online Trading Academy, and Private Discord Community where you will meet like-minded and passionate crypto investors and traders.

Join the revolution overtaking the cryptocurrency markets today!