Amazing Volatility! Is this the reversal we’ve been praying for?

The total Cryptocurrency Market Cap has risen by 0.84% today, or about $7.5B. The structure of today's candle is a hammer candle doji, with a squat body and a long price tail underneath. Typically associated with bullish reversal patterns. We remain at the bottom of the Value Area Distribution, and our Moving Averages, while above us, are beginning to narrow and go flat, a sign of consolidation or potential trend reversal.

We are still trading underneath our range Point of Control and Base Line, so there is stiff resistance above us. We remain in a regime dominated by Short Term Holders and Short Term Speculators, and most of them are underwater, meaning that as prices rise with a Bear Market Rally, those market participants will take rises in price as an opportunity to exit their positions at break even, contributing to the strength of resistance.

Volume on today's market cap move is exceedingly high, similar to yesterday's. Bullish Divergence is still developing, on both Bitcoin and Total Market Cap on the Daily and Weekly timeframes.

This is setting the stage for another Bear Market Rally, so risk-adjusted long exposure is the R/R play here. However, we are still operating in a bearish macro and fundamental environment, so I don't want anyone to get too excited. Take long positions with correct position sizing, and be prepared to add to short positions in the event we do experience a rally during periods of overbought market conditions. Alternatively, buying downside put protection in the form of Options Contracts is a good option for those more experienced traders.

With regards to portfolio allocation, we still recommend no more than a 25% allocation of your total desired allotment to Bitcoin at this time. We don't recommend portfolio positions in other altcoins at this time.

Bitcoin Analysis

Bitcoin is trading up 2.5% today, and quickly approaching the current Point of Control resistance level at 19882. Still grinding along the lower support level with no significant trend to speak of. Moving averages are beginning to contract and move sideways, indicating consolidation or potential trend reversal.

Mynx and Relative Strength Index are both printing Regular Bullish Divergence on both the Daily and Weekly timeframe. While we may experience another Bear Market Rally with current prices as our lifting off point, I want individuals to be careful that the macro and fundamentals haven't changed. Expect upside to be more risky and reduce your position sizes accordingly.

If long positions are entered, Quadrigo is suggesting a volatility adjusted Stop Loss slightly below our current support level - $18.067.

Upside targets - $19.882 - $21.378 - $23.122.

On the meso timeframes we are in an uptrend, with price trading above our Base Line and all major Moving Averages. Price has accepted above the current Value Area and Mynx is about to enter mild overbought territory, which with crypto often implies further upside. Pullbacks to 19.3 to 19.2 can be bought here, with Stop Losses placed below the current Value Area, about $18.6K.

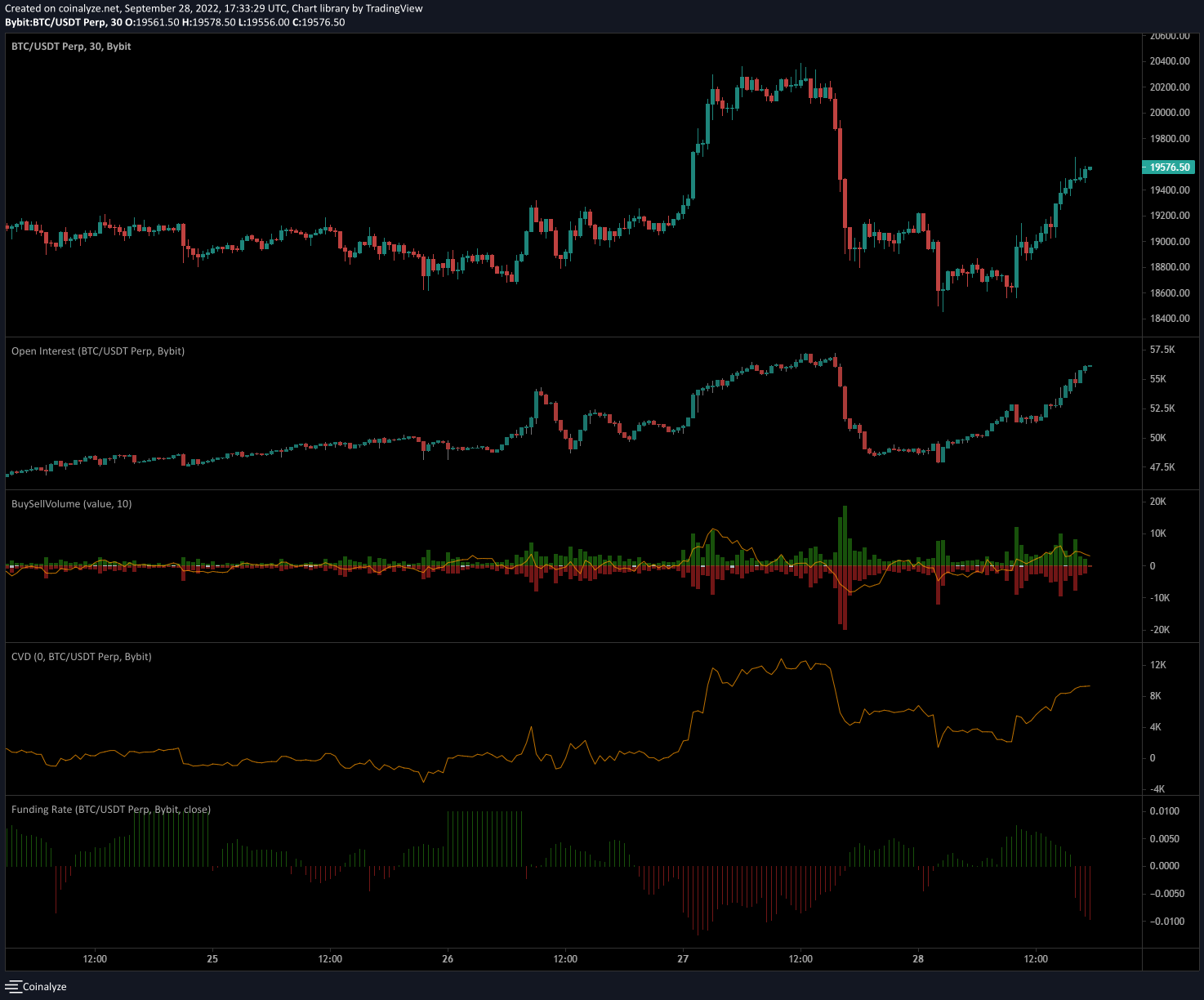

Monitoring the LTF charts, we can see that Open Interest is rising alongside price, which is a very good thing to see. Cumulative Volume Delta and Buy/Sell Volume also indicate that buyers are in control and no immediate warning signs present themselves. This movement seems to have fuel to move further up.

Note that Funding is currently negative, and if Buy/Sell Volume begins going flat or declines, I would begin looking for an exit for your long positions and an entry for your short positions. We all know what happened yesterday...

Altcoin Analysis

Large Changes in Open Interest

REEF is hard to read, HNT I shorted, ACH I longed.

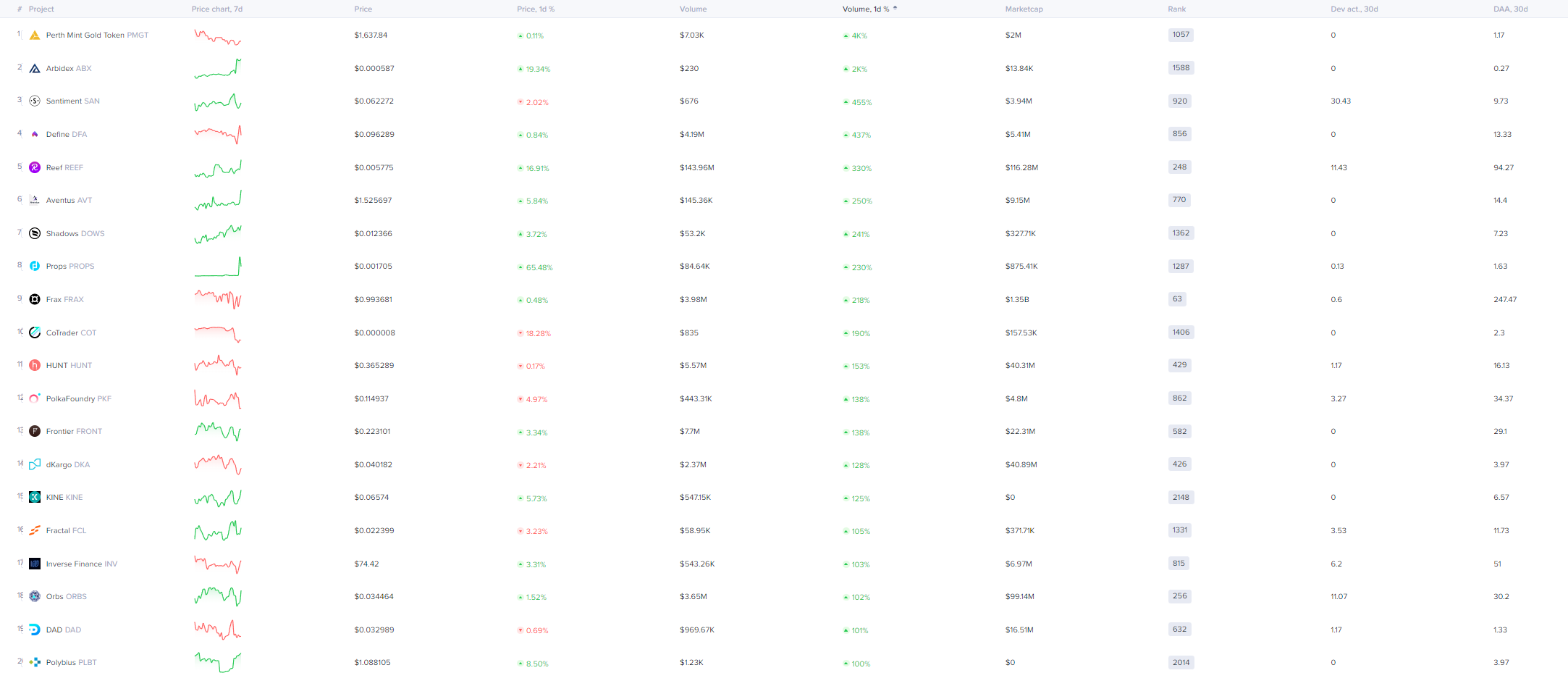

Santiment Screener

These are coins that are experiencing a surge in Volume and On-Chain Activity. Arbidex and Fractal warrant further investigation.

If you'd like to learn to read the pulse of the market yourself, there's no better place to learn and grow than in the Cracking Cryptocurrency Premium Trading Group!

Receive daily Trading Signals, Market Analysis, Insights from our team of Junior and Senior Analysts!

Learn to trade in our Online Trading Academy, utilize our proprietary suite of Premium Indicators, take part in our Community Mentoring Program, and much more!

To start your journey on the Pathway to Profit, find the plan the meets your budget today!