Bitcoin Did What?! – Breakdown of Today’s Volatility

Total Marketcap Analysis

Today the cryptocurrency markets surged, raising the total market cap by nearly 6%. Unfortunately, it was not to last as investors immediately took elevated prices as an opportunity to extract profit or realize breakeven positions. As of writing, the market cap is actually net down 1.17%. This confirms the observations made earlier that current price action is completely dominated by short-term holders who are suffering massive unrealized losses following the recent rejection from $20K, and contributes to a fundamentally grim view of the markets moving forward.

Analysis of all market index perps on FTX indicates that currently all sectors are conforming to the TOTAL market cap trend, inverted hammer, investors grabbing exit liquidity. No particular sector is outperforming the market as a whole currently.

On Chain Metrics

All on-chain metrics point to Short Term traders/investors completely dominating the scene. Old coins are staying put, and while this can be considered constructively, in my opinion the real interpretation is long term hodlers are strapping themselves to the ship regardless of where it takes them.

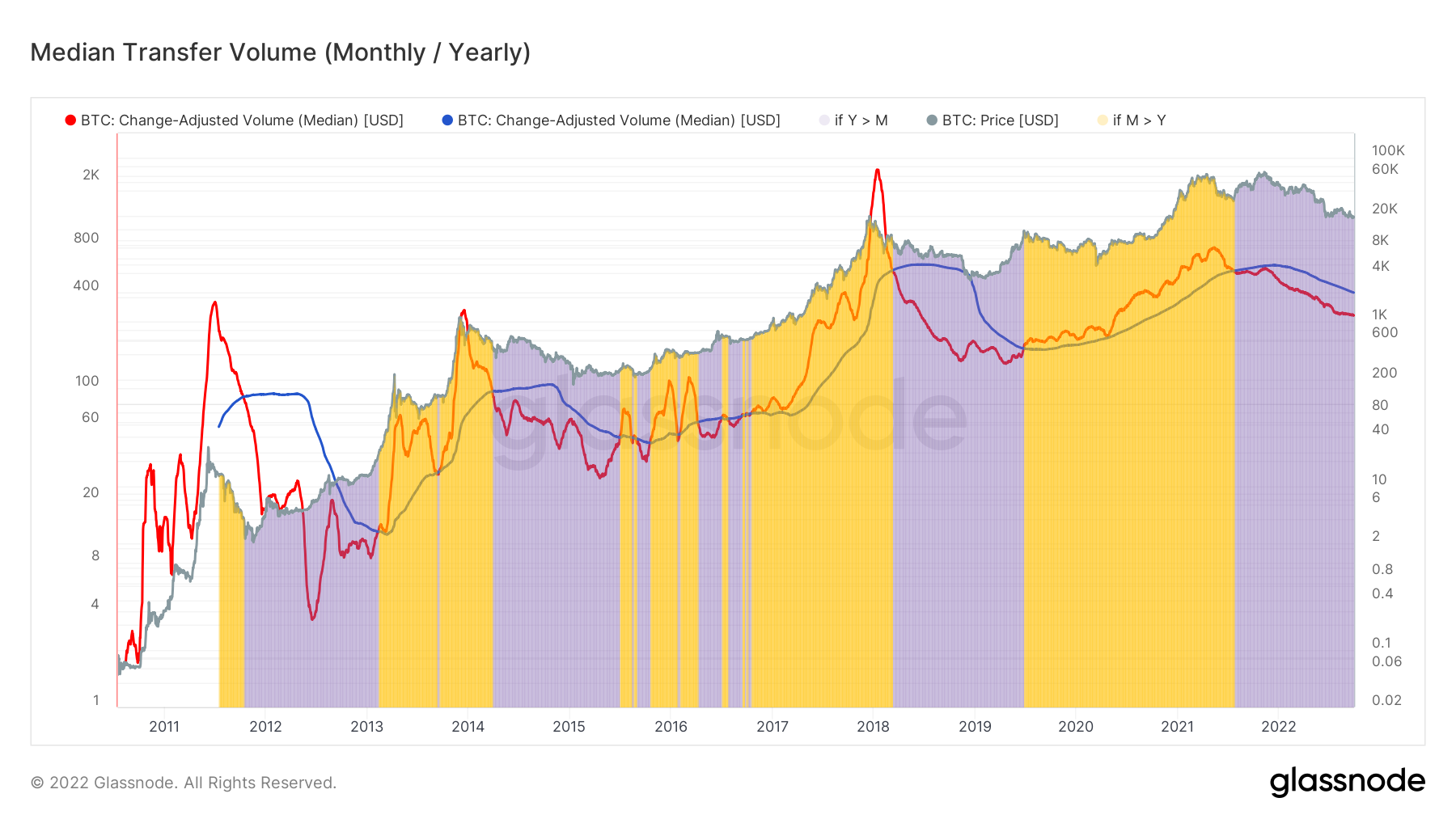

Our first metric from Glassnode is Median Transfer Volume. This metric can be used as a proxy for retail participation. As this metric increases, it indicates increased retail speculation and network participation, as it declines it indicates a decrease in retail speculation. Prices go up, on average, when retail is rushing into the market.

Median Transfer Volume was declining rapidly for most of 2022, and while it is still grinding lower, the velocity of its descent has softened, indicating an equilibrium in network participants is underway. This means the flushing out of speculative money, which typically occurs in late stage bear markets.

Median Transfer Volume plotted month over month compared to year over year gives us a nice two lines cross indicator for macro market regimes. When the monthly median transfer volume is increasing over the yearly base line, we can interpret that as increased retail interest and speculation on Bitcoin, which is supportive of prices climbing.

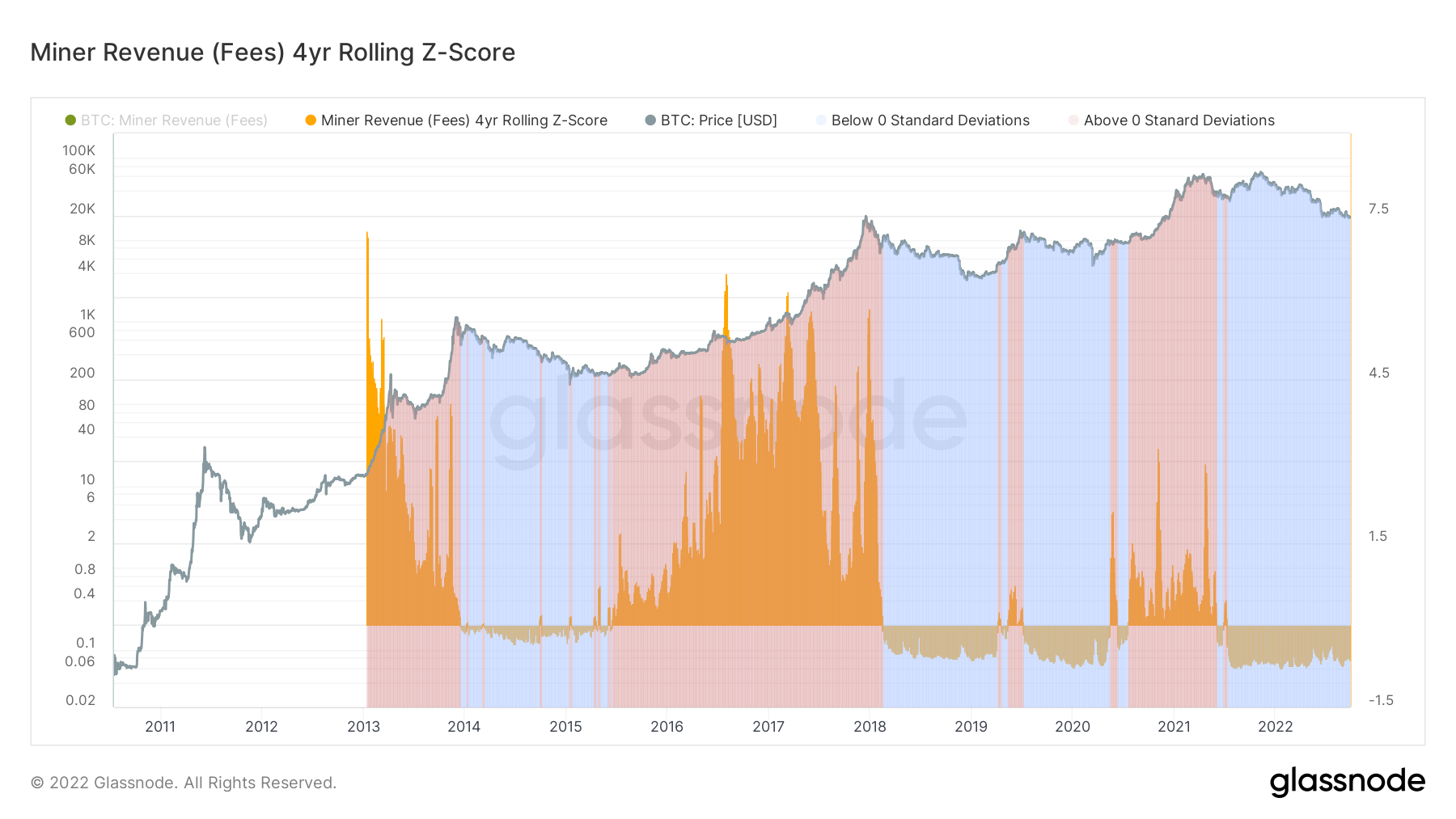

Finally we will look at a Z-Score of a metric we've observed before: Miner Revenue from Fees. This has been a leading indicator for major market reversals. The more demand for blockspace, meaning the more network congestion, the more users will pay in fees to a miner to have their transactions prioritized. These are all signs of a bull market, and the current regime of revenue from fees being crushed are indicative of bear markets. Shifts in this metric often lead price reversals. One to monitor closely.

Bitcoin Analysis

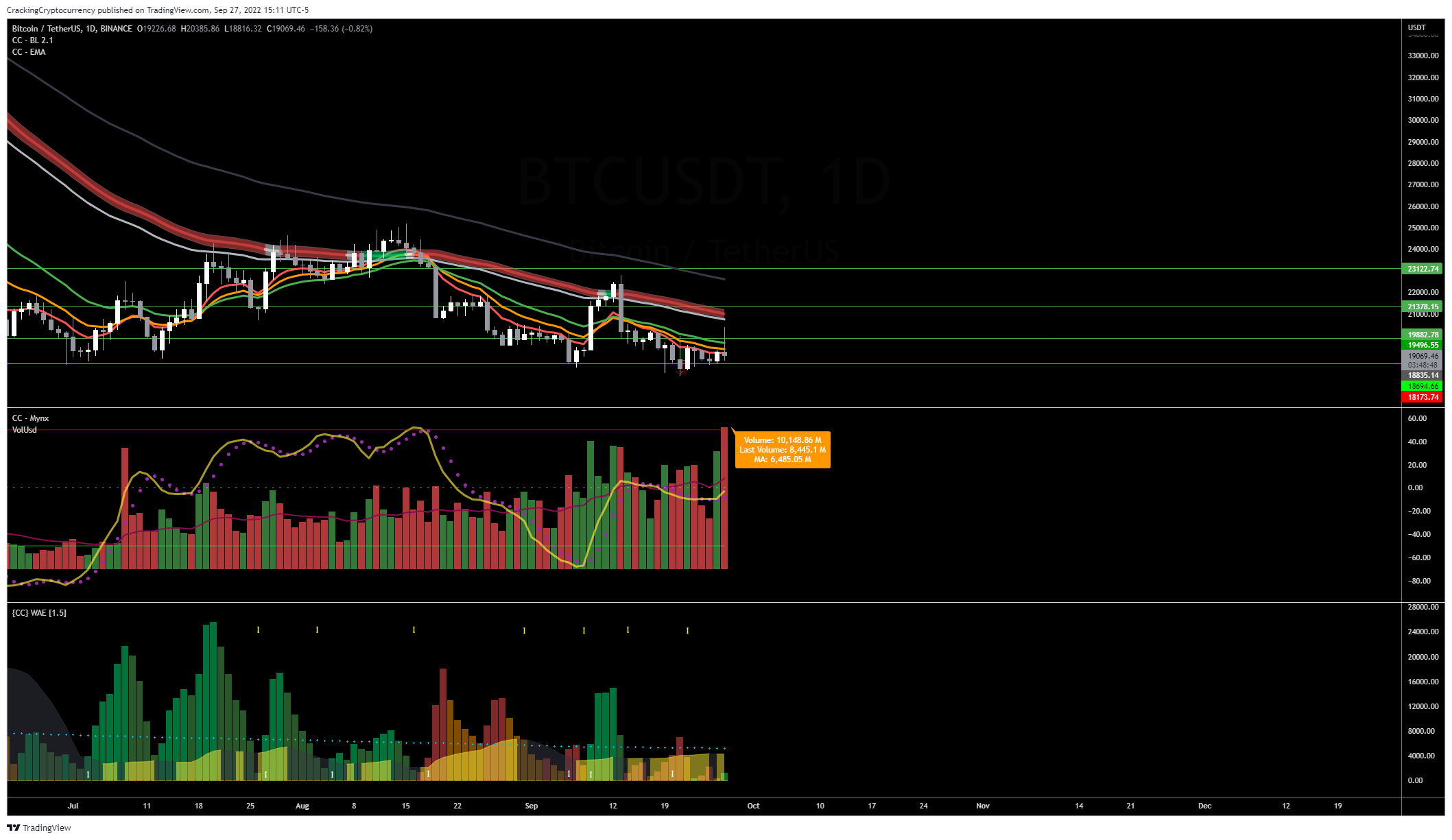

Bitcoin rallied mightily today, smashing into the first Take Profit target I recommended on yesterday's Breaking Bitcoin Market Update live stream, before collapsing back down to slightly below our current level of support. The volume on today's daily bar was the largest that we've seen in this consolidation period. Traders definitely need to be on the alert for an expansion in volatility, as I feel the full extend of the macroeconomic factors have yet to be priced in.

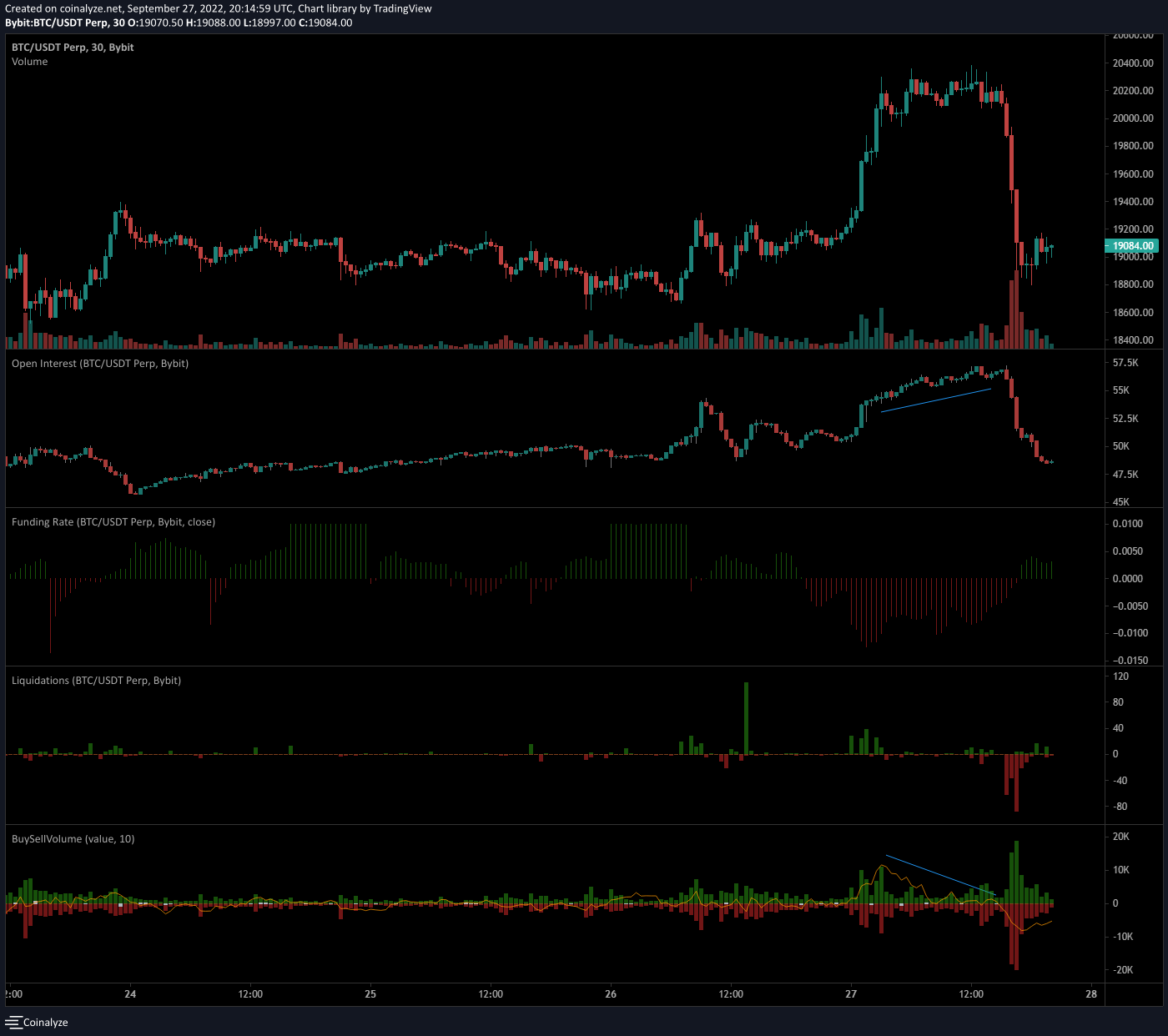

As we can see from this chart, following Bitcoin's mighty pump, Buy/Sell Volume begins collapsing along with the rise in Open Interest. A clear warning sign to long biased traders buying the pump. The levee broke, and currently we're seeing no constructive data from these metrics. Time will tell if buyers step back in with sufficient force, but either way, just more evidence to the reality of volatility and STH dominating market churn.

Altcoins of Interest

Large Changes in Open Interest

Not much on the radar today, the most exciting asset to be watching is UNI - however this meager chance in OI is not something I usually chase.

If you're tired of navigating the markets alone, there's no better place than the Cracking Cryptocurrency Premium Trading Group! Come join us in our quest to conquer the markets, one position at a time!