Is The Rally Over So Soon? A Break in the Bitcoin Glass

Total Market Cap is in a macro downtrend, indicating more money is leaving the cryptocurrency sector than entering it.

We have seen a slowdown of this phenomenon since we established our local bottom in mid June 2022, but have resumed the downtrend ever since the brief rally of Bitcoin to $24,000. Since then we continue to put in lower lows, and lower highs.

The "mini-rally" of the last few days is showcasing volume divergence, we are moving up weaker with less money, not a healthy sign for a true recovery.

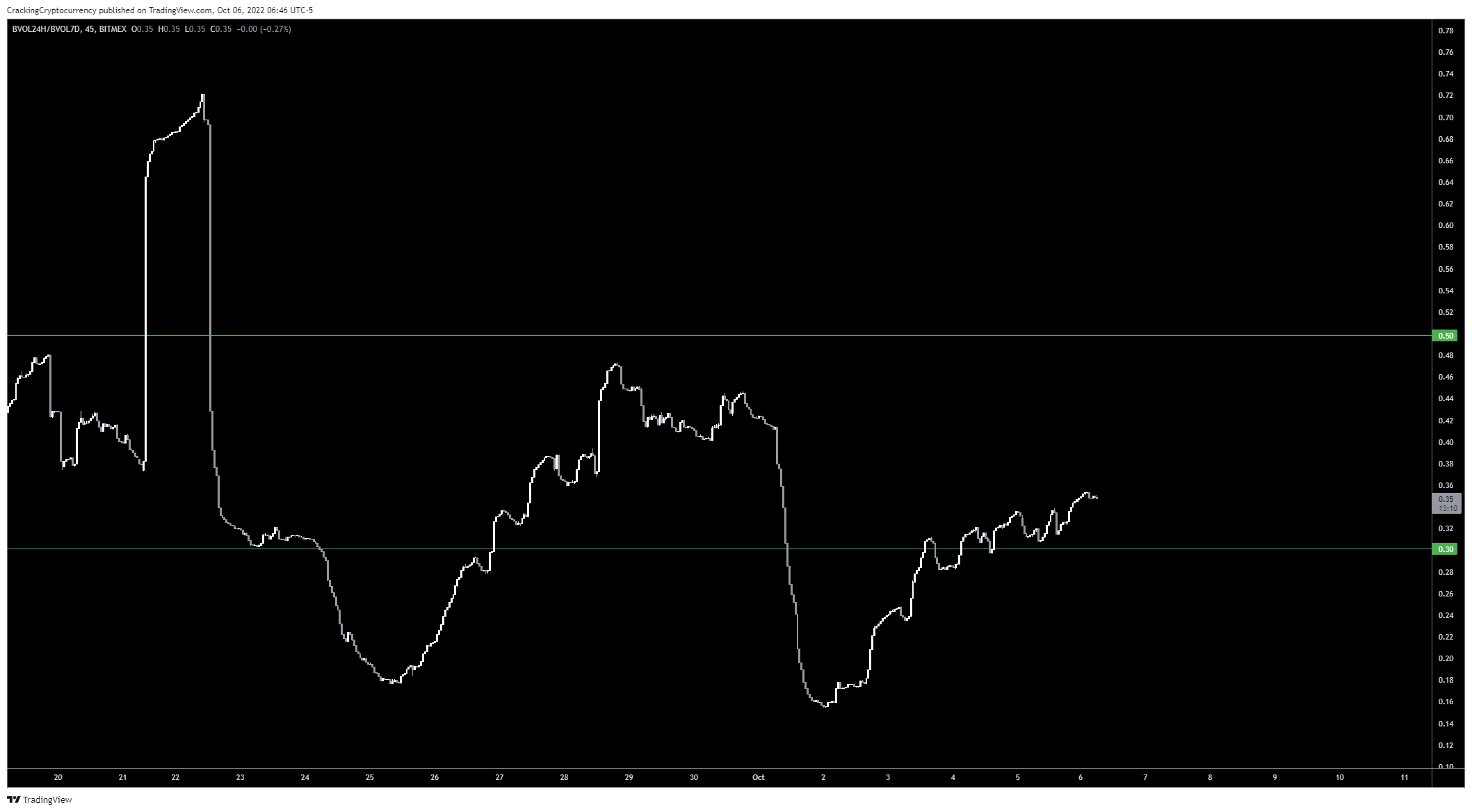

Our Bitcoin Volatility is indicating Bitcoin is in the middle of its volatility distribution. We are not experiencing either low volatility (the safest time to enter a position) or high volatility (the most dangerous time to enter into a position).

A chart of USDT Dominance (the market share that Tether holds) is enlightening. We can see USDT Dominance peaking in mid-June (our local bottom) and entering into a downtrend correlating to our Bear Market Rally to $24K.

However, since mid-August USDT Dominance is on the rise again, indicating investor uncertainty and the desire to be in Stablecoins over volatile crypto assets.

Despite this negativity, analyzing the actual chart of Bitcoin reveals that we are trading inside of our Value Area Distribution. We are currently trading at the upper range of the High-Volume Node surrounding our local Point of Control (the current fair market value of Bitcoin).

Directly above us is a large gap in volume, all the way up to $21,600. When price enters into a low-volume node, it tends to charge through until it reaches resistance. We remain fairly confident that Bitcoin can achieve this movement, so holding long positions is still viable with re-evaluation or profit taking recommendations coming when we arrive at our resistance target.

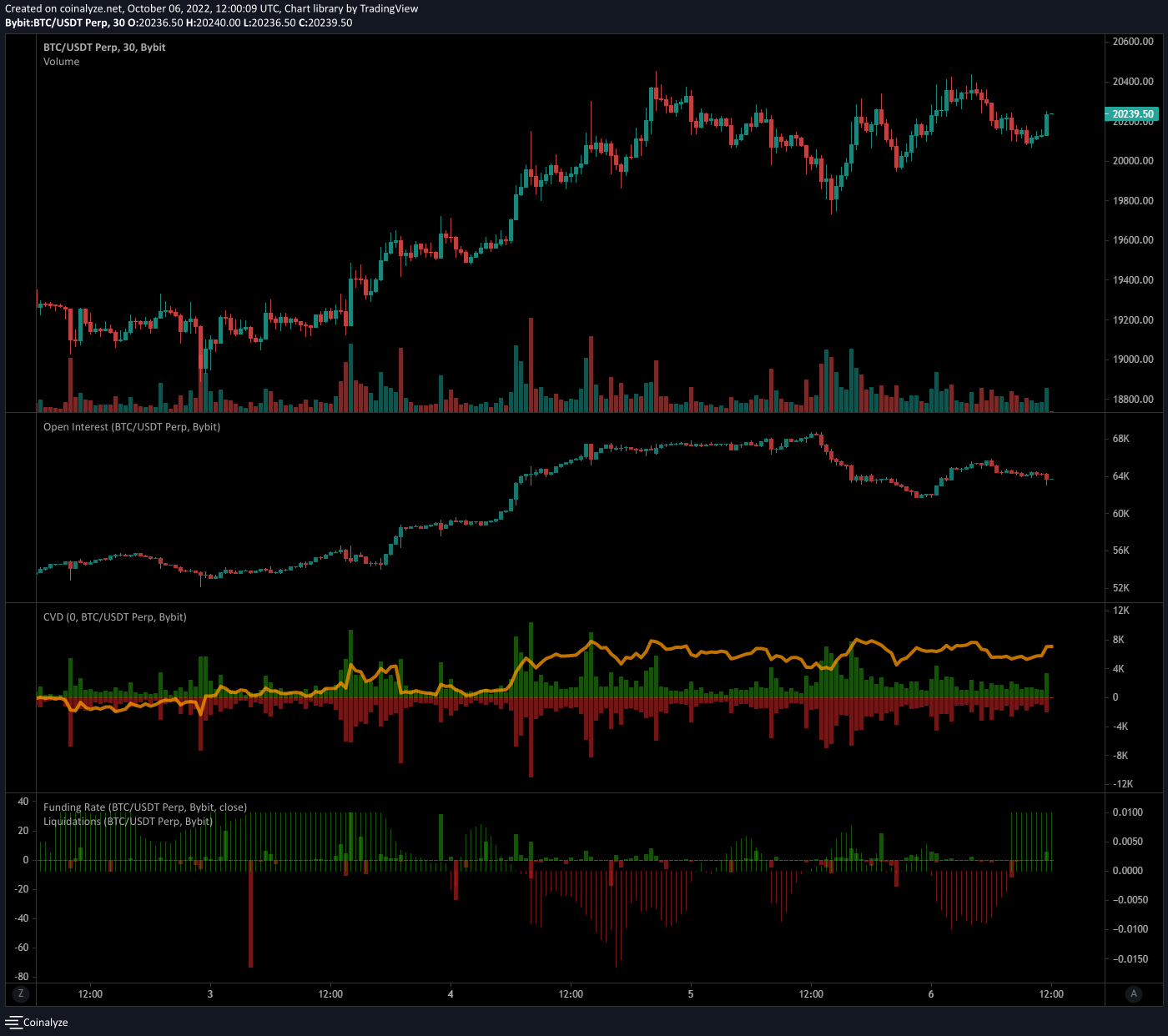

Analyzing the LTF and specific exchange data, we can see that Open Interest rose leading into the rally, however over the last two days we’ve just been ranging here in a very distributive-looking pattern.

Open Interest confirms this distributive behavior, as Open Interest ceased rising as Bitcoin first reached $20,400. As Open Interest stopped rising in line with price, the rally was not able to sustain itself, and Bitcoin entered into distribution mode.

Cumulative Volume Delta and Buy/Sell Volume also confirm this. CVD is clearly ranging, indicating that buyers and sellers are at equal strengths, with no clear signs of accumulation.

While this pattern may change, allowing Bitcoin to break to the upside (to confirm our HTF analysis above) currently the rally is on hold until buyers can show more strength.

Altcoin Analysis

The largest changes in Open Interest have occurred in SUSHI, ENS, and GLM.

SUSHI USDT - ByBit https://www.bybit.com/trade/usdt/SUSHIUSDT

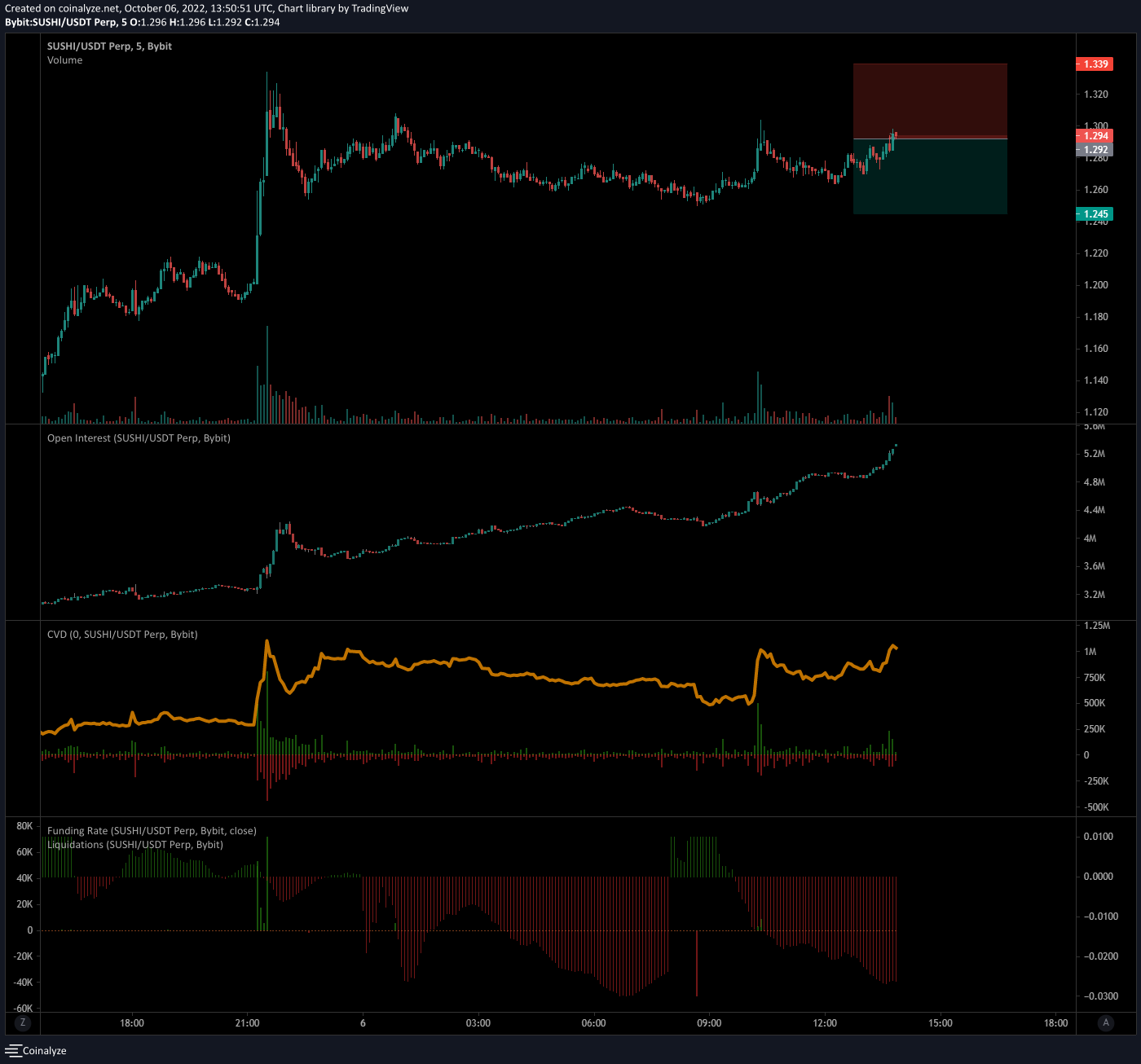

SUSHI is rather interesting. After rallying to $1.334 yesterday, we entered into a distribution pattern. Open Interest began to rise consistently, however we can see that sellers were in control of much of that positioning as evidenced by Cumulative Volume Delta.

We have formed a strong resistance area at $1.30, and I would recommend that one look to short around that target area.

Invalidation would occur if buyers increase in strength and we see many short positions get liquidated, but overall, this is a bearish reversal setup.

ENS USDT - ByBit https://www.bybit.com/trade/usdt/ENSUSDT

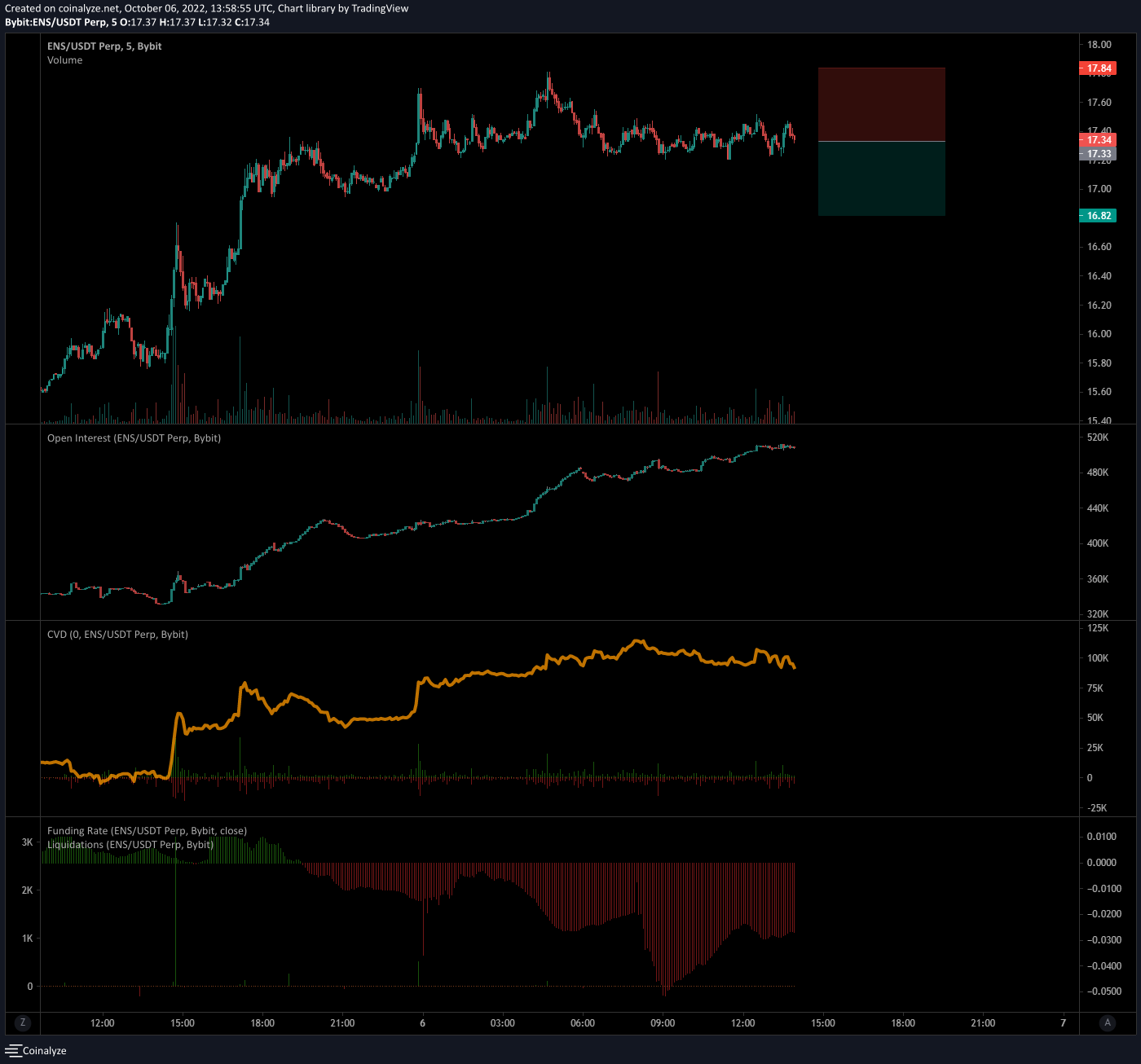

ENS is also very distributive. After rallying to $17.81, the rise in Open Interest has stagnated, and as we can see from the chart now OI has gone completely flat.

Cumulative Volume Delta shows that throughout this range, sellers have taken control. Negative Funding confirms this.

We recommend that shorts be taken in this area, or that one be on the lookout for a momentum opportunity to enter to the downside.

If you'd like to learn how to keep yourself cool with volatility heating up, there's no better place to learn and grow than in the Cracking Cryptocurrency Premium Trading Group!

Receive daily Trading Signals, Market Analysis, Insights from our team of Junior and Senior Analysts!

Learn to trade in our Online Trading Academy, utilize our proprietary suite of Premium Indicators, take part in our Community Mentoring Program, and much more!

To start your journey on the Pathway to Profit, find the plan the meets your budget today!