The Ethereum Merge Is Here – Time For A Sell Off!

This morning a historic event took place: Ethereum successfully transitioned from Proof of Work to Proof of Stake. This event has been in the making for years and marks the successful collaboration of dozens of teams and hundreds of individuals. With this transition, the world's energy consumption has immediately dropped between 0.2-0.5%, depending on estimates.

Ethereum supply is also now officially contracting, meaning there is less Ethereum in existence now than when the Merge occurred. Long term this dramatically reduces the daily sell pressure on Ethereum, and may be setting up one of the most bullish catalysts for the second largest cryptocurrency since the announcement of NFTs.

Yet with all the excitement, the legendary achievement, and the implications for the cryptocurrency markets moving forward: overall the price action has been relatively unimpressive. A massive amount of ETH was moved onto exchanges immediately following the successful merge, resulting in an almost immediate -10% movement for ETH.

The rest of the crypto market is showing a mixed bag today, notable performers are CEL +12.6%, ATOM +6%, COMP +6%, LEO+6.3%, OSMO, GMT, and DFI. The rest of the market is down a modest amount. Overall, we are still in crab market mode and LTF range strategies and grid strategies are your best bet.

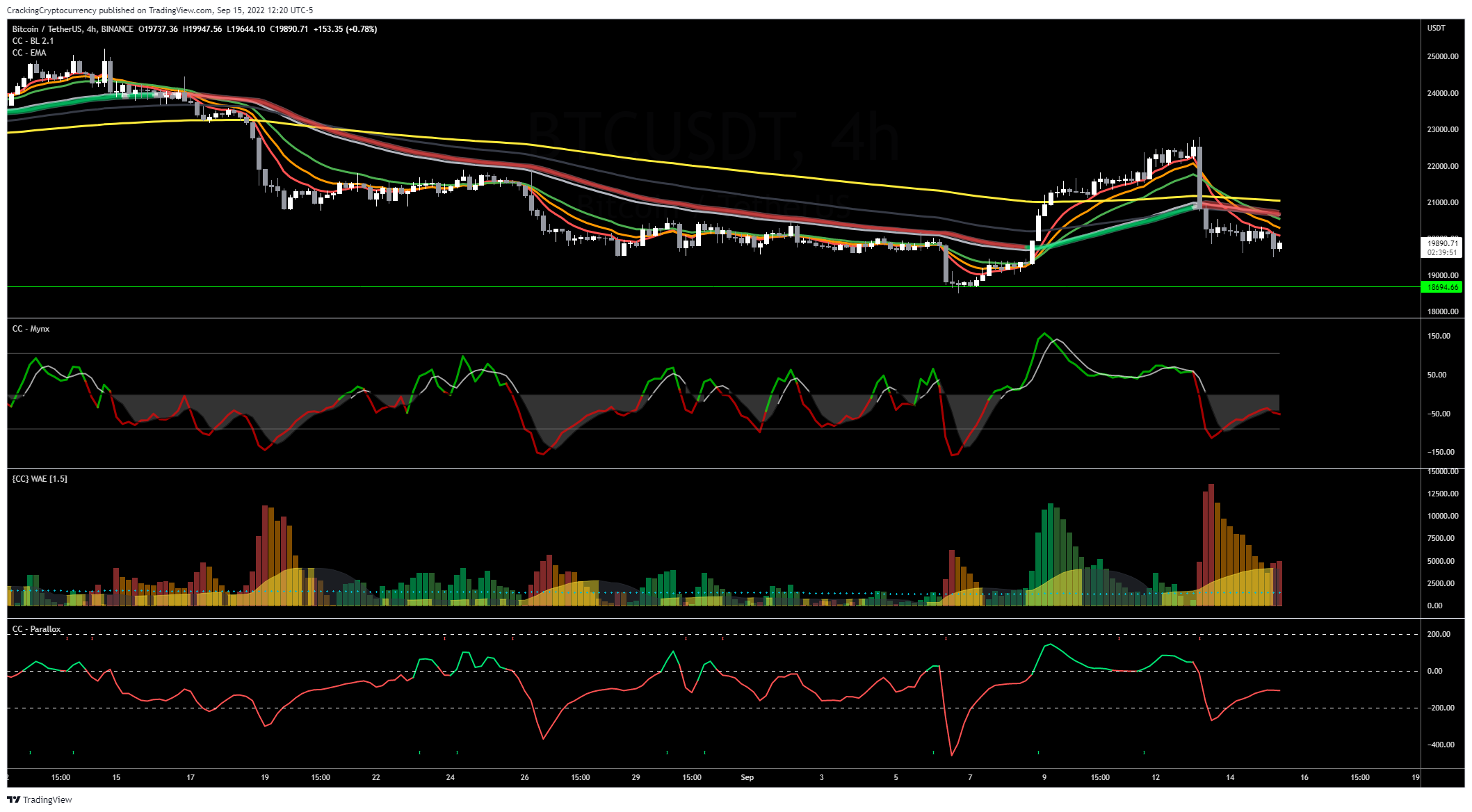

Bitcoin Analysis

Bitcoin is still trading below our Daily Base Line as well as the rest of our major moving averages. Our moving averages are tightly compressed together, indicating the lack of a strong trend and indicative of consolidation and choppy markets. Our momentum oscillators are now back in bearish territory.

Current support sits at $18.700, so Bitcoin still has the potential to form a higher low and push to the upside. From a R/R perspective, the best play is to remain with our recommendation of 25% allocation of desired Bitcoin holdings at current spot prices in this range. We also recommend either purchasing options puts to profit from potential downside, the premium paid should be 10% of the fiat value of your Bitcoin holdings and the expiration should be at least out to the end of December. As an alternative option, you can also choose a futures short position. If so, we recommend futures with expiration such as those on ByBit.

Altcoin Analysis

Large Changes in Open Interest:

XNO USDT +73.4%

BEL USDT +39.09%

KNC USDT +17.2%

BLZ USDT +15.86%

BOBA USDT +14.98%

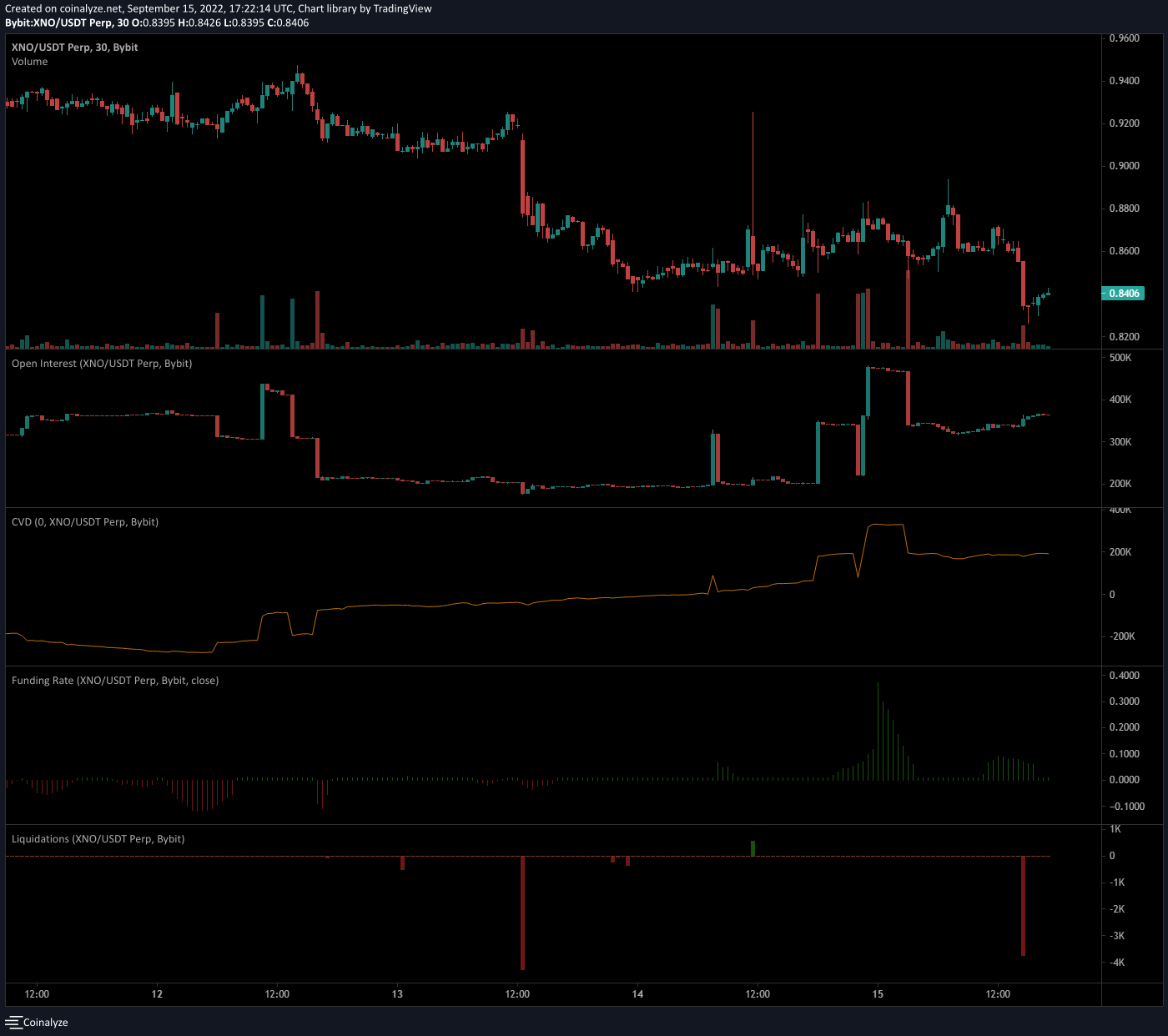

XNO USDT

XNO is a recent listing on ByBit. It has largely moved sideways since it's listing, with a small pump and a current dump back down to support. I generally like coins that go sideways, or go down upon listing. Generally there will be sideways accumulation before a large pump. XNO is currently at support and trending back upwards after reaching oversold conditions.

Here we can see that Open Interest is on the rise for XNO, and that even during the dive CVD continued to rise, indicating accumulation and that buyers are actively attempting to absorb XNO sell side. There was just a big liquidation of longs, so this flush out might bode an attractive entry point.

BEL USDT

BEL is also a recent listing on ByBit, and unfortunately this coin screams stay away. It's been down only since listing, and while we might be at a turning point CVD is down only as well, indicating massive sell side pressure. Also, note that every local bottom that lead into a moderate pump is marked by long liquidations, something we don't have on this current dump.

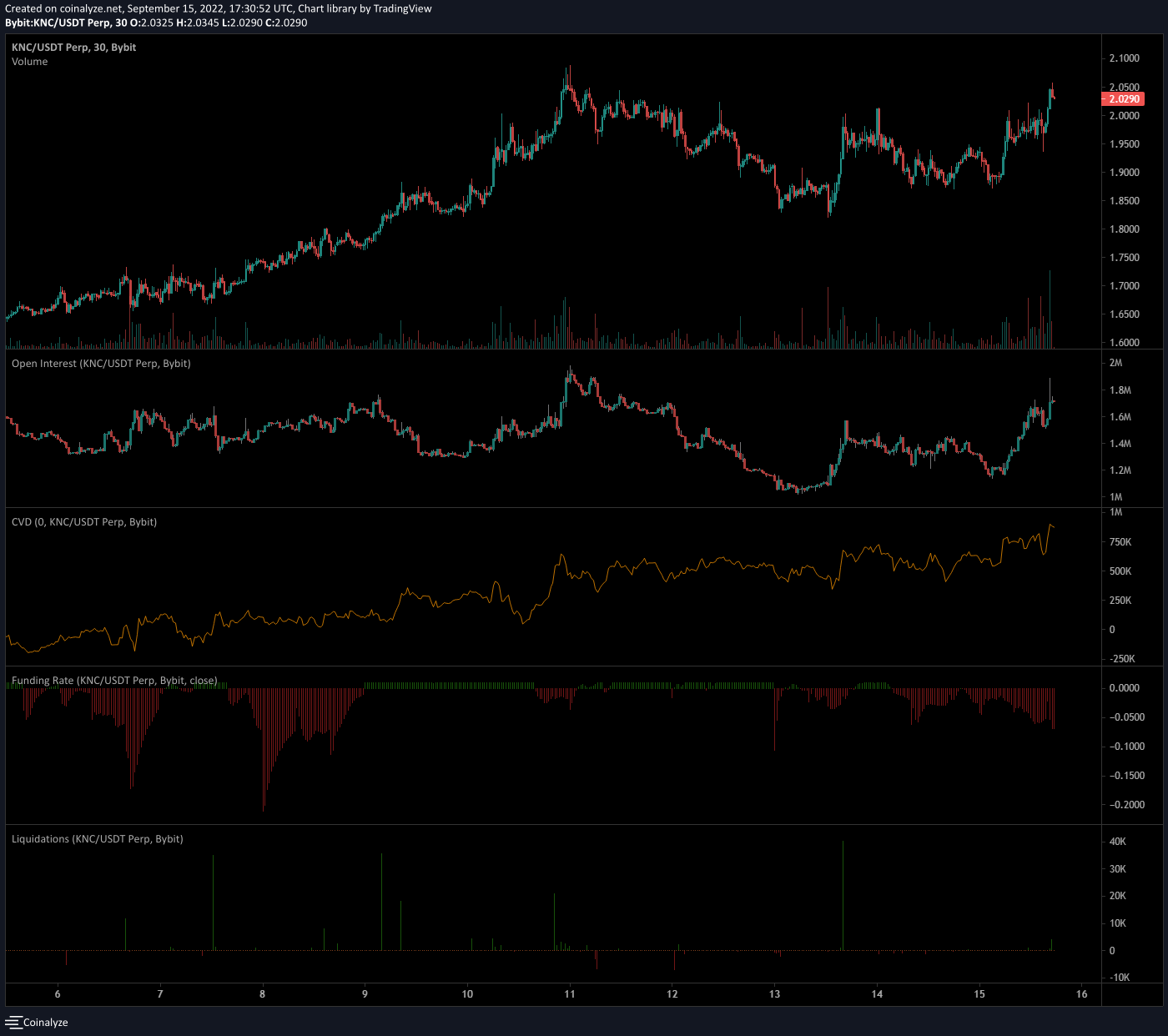

KNC USDT

This is the most constructive chart we've looked at so far. KNC has been on a nice run, and the current slump seems to not have dissuaded the buyers very much. Open Interest has continued to climb alongside CVD, indicating that there is still plenty of potential bullish momentum ahead of us. Note that funding is also negative, meaning lots of players are taking on excess leverage to short KNC, setting up the stage for a short squeeze.

KNC is currently trading at resistance, and we just had a nice little pump followed by short liquidations. Generally not the best place to go long, I would wait for a pullback or monitor for a proper breakout above resistance before entering positions here. However, definitely one to keep your eye on.

Summary of Today's Premium Trading Group Results:

CLOSED AGLD USDT Long - Position reached Target 1 for 50%, then closed at entry price stop loss.

Trade Performance: +3.86%

P&L: +$2568.06

Account Growth: +0.8%

CLOSED ATOM USDT Long - Position reached Target 1 for 50%, then closed at entry price stop loss.

Trade Performance: +1.86%

P&L: +$991.62

Account Growth: +0.31%

CLOSED RVN USDT Short - Positioned reached Target 1 and Target 2 for 50%, then closed at Target 2.

Trade Performance: +9.20%

P&L: +4660.12

Account Growth: +1.46%

CLOSED CRV USDT Long - Trade hit SL.

Trade Performance: -14.17%

P&L: -$5567

Account Decline: -1.72%

CLOSED CREAM USDT Long - Trade hit SL.

Trade Performance: -5.85%

P&L: -$6031

Account Decline: -1.89%

CLOSED HBAR USDT Long - Trade hit SL.

Trade Performance: -5.11%

P&L: -$2985

Account Decline: -0.95%

CLOSED FTT USDT Long - Trade hit SL.

Trade Performance: -5.19%

P&L: -2954.05

Account Decline: -0.95%

OPEN SD DEMA Positions:

Performance: 84.46%

Unrealized P&L: +$12670.48

Unrealized Account Growth: +4.09%

Summary:

Total Performance: 69.06%

Total P&L: $3352.74

Total Account Growth: 1.15%

If you're tired of navigating the markets alone, there's no better place than the Cracking Cryptocurrency Premium Trading Group! Come join us in our quest to conquer the markets, one position at a time!