Crypto Markets Tremble in Anticipation of the FOMC Rate Hikes

A perilous and fearful Monday is upon us! Happy start to a fresh week Cracking Crypto Community, I hope your weekend was enjoyable. As we start, a show of solidarity with all our friends down in Puerto Rico who are struggling with the impact of Tropical Storm Fiona. I have many friends down therew and 90% of the island is currently without power or water based on latest estimates.

Although small, the crypto community on Puerto Rico is large. Are we really not going to point out the correlation between the sell off on Bitcoin occurring almost as soon as the storm began to strike Puerto Rico? Hmm. Anyways, big shout out to the crypto community in Puerto Rico and I implore my readers to pay attention to situation, stand in solidarity with me, and do what they can to help.

Overnight the overall crypto market cap declined by nearly 6%, smoking millions of dollars away as Bitcoin broke below it's current low. In with a strong rebound as of this afternoon, all eyes on a potential reversal. However, altcoins are continuing to bleed out even as Bitcoin bounces from it's low.

This week is going to be an interesting one. We will have another FOMC meeting where we will learn whether the Fed will raise rates by 75bps or 100bps (my bet is 100). The market is trying to pre-price in the impact of that decision, but we've typically seen the market pump immediately leading up to the FOMC meeting and immediately tank afterwards. Trade accordingly.

The FOMC decision will be on Wednesday at 2pm EST.

Remember that the market tanked last week following the CPI print. Core CPI rose 0.6%, hurting the "inflation is transitory" argument and incentivizing the Fed to remain hawkish. Sovereign nations are beginning to worry about the strength of the United States Dollar, and there is a lot of chatter about the Fed pivoting to 'bring back the good times.'

However...the reality is the Fed doesn't care about other nations. They have TWO mandates. Only two. The dollar-denominated debt of other world economies is not one of their mandates.

Interestingly enough, wages are rising in the United States. Here is an interesting thread by Lisa Abramowicz pointing this out. Worth a read through the comments as well to see dissenting opinions.

The Cracking Cryptocurrency Premium Signal Service is now proud to offer Options Signals! Now Premium Members will receive Options Signals in addition to their current Spot and Futures Market signals. We are focusing on ByBit's USDC margined contracts and FTX US Derivatives USD margined contracts. The first flew of trades with expirations from the 23rd of September to the 30th of June 2023 have already been posted.

Bitcoin Analysis

Bitcoin sold off down to our critical support level last night. We saw significant buy volume step in at that point and as a result price has risen nearly 6% off of last night's lows. We are now forming a bullish reversal candle known as a Hammer Candle. When these occur at significant levels of support they often foretell upwards price movement and a temporary reversal in trend.

Real Volume is very high on today's candle, higher than all the previous candles with the exception of the CPI sell off candle. This is a very positive sign for the bulls.

Mynx, our primary momentum oscillator, is hovering slightly below it's zero line. While this is indicative of a minor bearish sentiment, overall the reading is neutral. We are not oversold or overbought, and so upwards price movement here could be met with little resistance.

At the four hour level, we can see that Bitcoin has risen to meet it's fast moving averages. Bitcoin is currently struggling to overcome them. Bulls are looking for a small pullback here followed by a higher low before a run at our next resistance level of 20K in the form of our Base Line and 55 EMA.

Turning to our LTF analysis, we can see that Open Interest has been dropping during this price increase. This lets us know that new buyers aren't coming in with the force necessary to sustain the pump. Also, Buy/Sell Volume has been dropping over the last hour indicating that there has been more selling than buying.

On top of that, Open Interest just started to rise indicating new shorts being put on. With positive funding, this does not bode well short term for BTC. We are seeing a pullback in Bitcoin's price to a target area of 19118.

Altcoin Analysis

HNT/USDT - ByBit

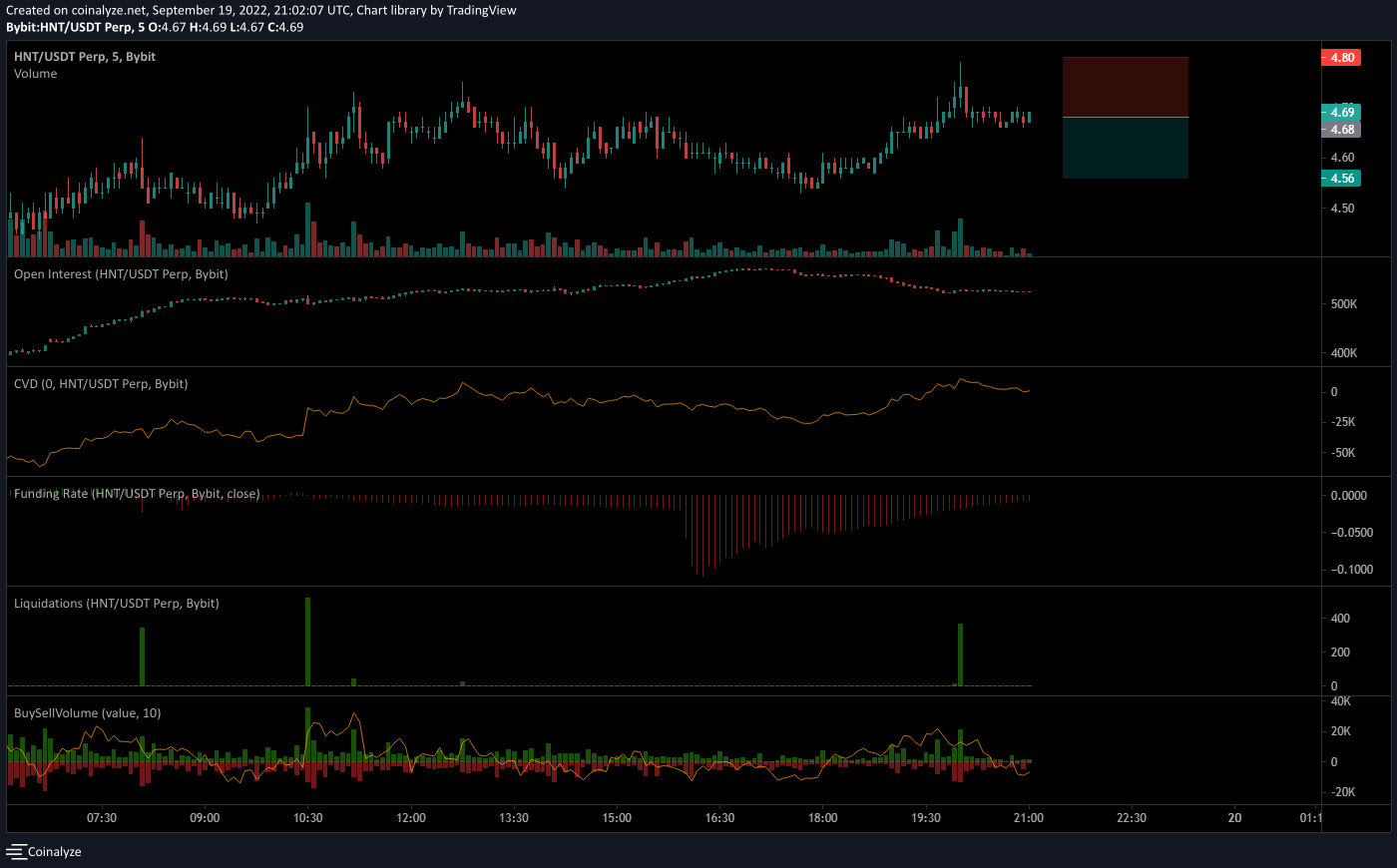

HNT had the large overnight Open Interest increase - +42.67%.

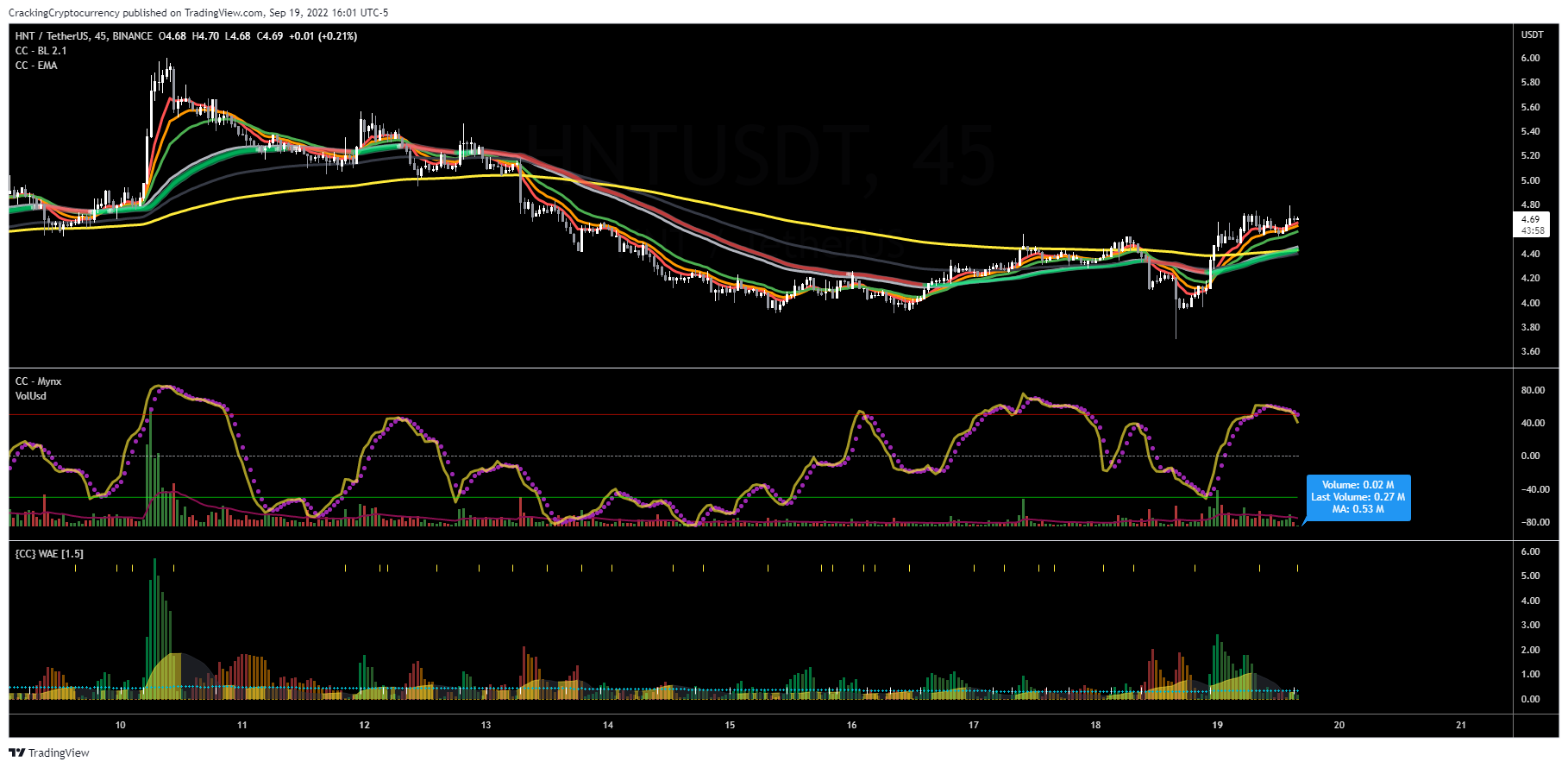

As we can see from the chart, HNT has not formed what we usually see in a sustainable uptrend. Price pumped very quickly, and as a result Mynx is now overbought and most concerningly, curling back under it's overbought threshold. As you can see, every other time this has marked the beginning of a downtrend in HNT's price.

Furthermore, we can see here that Open Interest is now on the decline and that Buy/Sell Volume is falling, indicating that new traders aren't interested in taking price higher and that sellers are taking control of order flow. HNT might be attractive to the long side if it's able to overcome these difficulties and find an new infusion of Open Interest, but as it stands this looks exhausted.

Crypto News and Opportunities

A new protocol called FluidityMoney is launching. It's a yield-generating protocol that rewards you for letting them use your crypto assets.

Here is a good thread explaining how they will earn yield and how you can engage with their platform.

The Ethereum Proof of Work fork blockchain fell victim to a replay exploit. This allowed funds to be siphoned by the attacker. As a result, the price of ETHW plummeted 37% hitting a fresh low.

If you'd like to improve your trading, there's no better place to learn and grow than in the Cracking Cryptocurrency Premium Trading Group!

Receive daily Trading Signals, Market Analysis, Insights from our team of Junior and Senior Analysts!

Learn to trade in our Online Trading Academy, utilize our proprietary suite of Premium Indicators, take part in our Community Mentoring Program, and much more!

To start your journey on the Pathway to Profit, find the plan the meets your budget today!