Crypto Traders in Recovery From Yesterday’s Dive

Happy Wednesday everyone! I hope the Cracking Cryptocurrency Community is doing well today! Certainly a mixed bag in the markets today. Notable outliers RVN is up 20% alongside CEL, while everything else seems to have stabilized with the exception of LUNC and LUNA, both plummeting off a cliff as the new ponzi comes to an end (hopefully).

As the entire market attempts to recover from the system shock that yesterday's CPI print delivered, I feel it's important to note some key points about the health of the American economy, to juxtapose it against the contagion we're seeing in the rest of the developed world.

To begin, although fear, uncertainty, and doubt is rampant in our space right now, it's important to zoom out, put things into perspective, and gain a firm foundation for our investment thesis. Although the current narrative is that the stock market and crypto is on the verge of another collapse, and while further downside is not impossible, things are not that terrible.

Stocks and crypto assets are still trading above their June lows, and most traditional assets are still up moderately from where they were before pandemic started. While a market on the verge of collapse would likely cause the Fed to pause in their tightening actions, for now, the Fed is fully committed to do anything necessary to tame inflation: that means stagnation in risk markets, low employment, and general malaise are acceptable collateral damage to them.

In contrast to other nations, like Europe, China, and Japan, the US is also being remarkably consistent and neutral with regards to printing their way out of the problem. Although we commonly like to bash on the Fed here in crypto land, I view this as a remarkable sign of strength and neutrality. Although the world isn't perfect, the Fed is maintaining it's neutrality and not allowing itself to be controlled by the current politicians in charge of policy.

There are two main philosophies regarding where we're at in the markets: that peak inflation is behind us, we are in and will be in a period of inflation and slow growth (stagflation), due to this the Fed will pause their tightening efforts soon, and the markets will respond positively. The other camp believes that this is only just the beginning, the Fed's tightening will cause further market collapse, and that Peter Schiff has been right this whole time. Which camp do you fall into?

Regardless of where you stand, it's clear that we're far from out of the woods, and that thought, patience, and determination will be required to do well in the current market environment.

Bitcoin Analysis

Bitcoin is struggling to do much of anything today. Following yesterday's nearly 10% decline, Bitcoin is solid as a rock at around 20,200 today. Nominal volume remains high, as has been the norm, and the Relative Strength Index is back in bearish territory however holding above it's Moving Average, indicating that we haven't fully lost the bullish trend yet.

If price holds here, we will have put in a higher low after making a higher high, and the stage might be set for continued upside.

Turning to our Pathways to Profit Trading Strategy, no positions are being recommended today for Bitcoin. We have dropped back down below the Daily Base Line, so the bias of the strategy is to look for shorts. However, our Moving Averages are very tight, which is indicative of a crab market or consolidation. We don't look to take trending positions in these conditions, so we will be looking for range bound opportunities.

Moving down to the four hour time frame, we can see that Bitcoin is trading below this Base Line as well. Our momentum oscillators recently reached oversold conditions, and have now recovered. This would usually be a sign to look for reversal long positions, however, due to the volatility at which we rejected from the high we always wait for our momentum oscillators to reset lest we enter on a false signal.

Should price break down from the current range, we would recommend looking for momentum shorts below 20,000, and we remain neutral on a Bitcoin breakout trade unless we can see price back above 20,800 and our moving averages begin trending back up again. Overall, this is a sit tight and wait situation for Bitcoin.

Altcoin Analysis

Large Increases in Open Interest:

By measuring which coins have the largest increases of Open Interest, we can identify the most likely profitable trade opportunities. We track all altcoin listings on ByBit's USDT Perpetual Exchange.

#1 CKB USDT +186.74%

#2 RVN USDT +100.35%

#3 AKRO USDT +50.79%

#4 LUNA2USDT +43.37%

#5 CVX USDT +32.27%

CKB USDT

CKB experienced a massive pump, followed by a swift sell off and then an aftershock pump. I've talked about this strategy many times: if you see an altcoin tear off and then sell off immediately, there's almost always an aftershock pump. If the coin pumps and then goes sideways, it's distributing and there's down only in it's immediate future.

CKB has had it's aftershock pump, and come down to it's current support level where it pumped previously coming off of the high. There was as period of distribution at today's Point of Control, so we want to be wary. This will likely act as a significant resistance level if CKB pushes back upwards.

LTF analysis shows that CVD is on the rise, so buyers are still in control and funding just spiked highly positive, indicating that a lot of traders feel strongly about CKB going back up. While this looks juicy, I would reduce risk and go at this with only 1% of your account looking for an intraday pop back up to today's Point of Control.

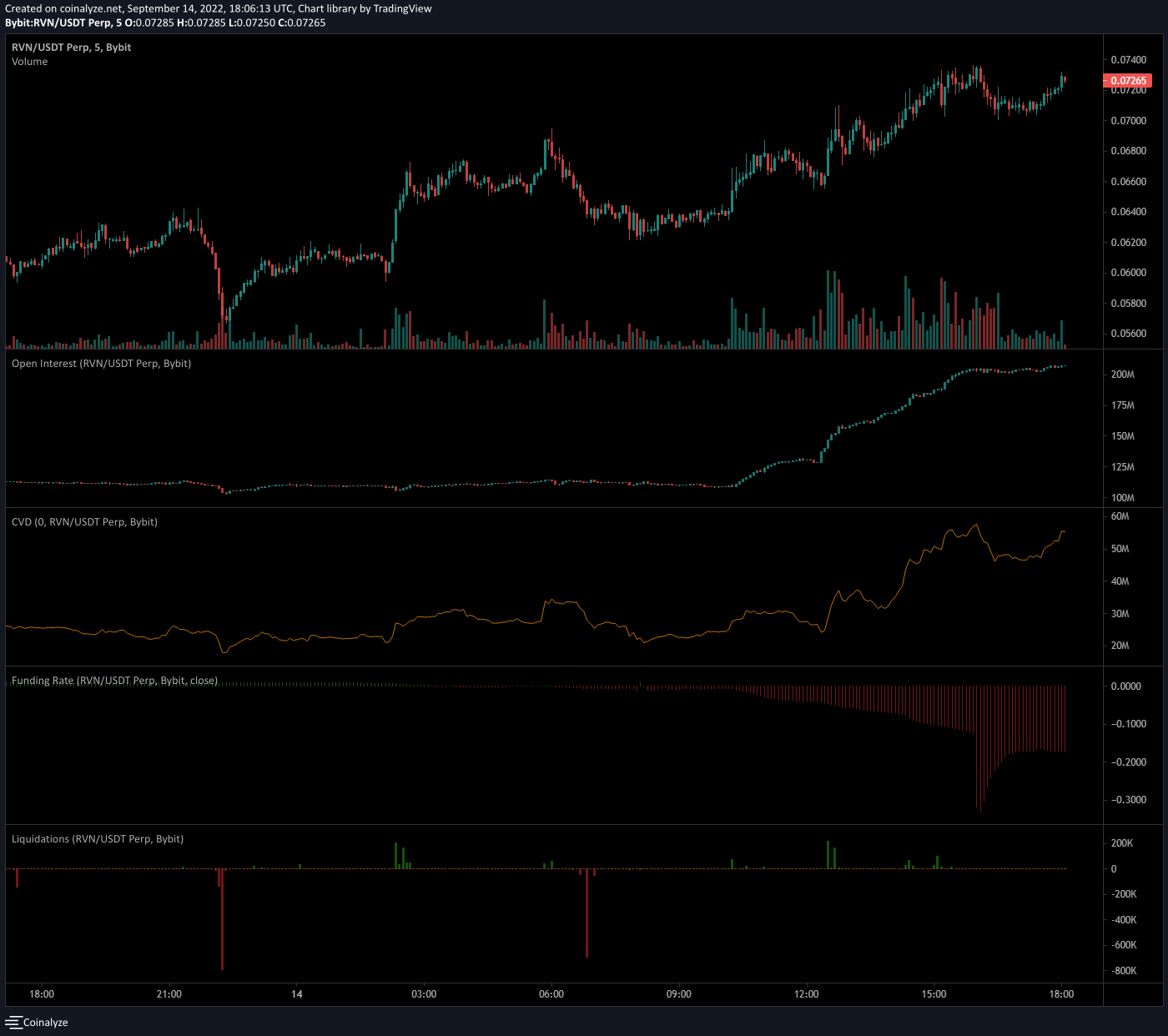

RVN USDT

After plummeting for the last few days, RVN completely reversed course and blew it's top off today.

RVN is currently clawing back up toward it's current high, and all eyes on whether RVN is going to put in a proper breakout here. I'm cheeky, so I took a long position here. This is strengthened by the fact that CVD and Open Interest are on the rise, and funding is negative so lots of traders are trying to short the top here. Setting the stage for a nice little short squeeze. Hold onto your hats, it might get wild!

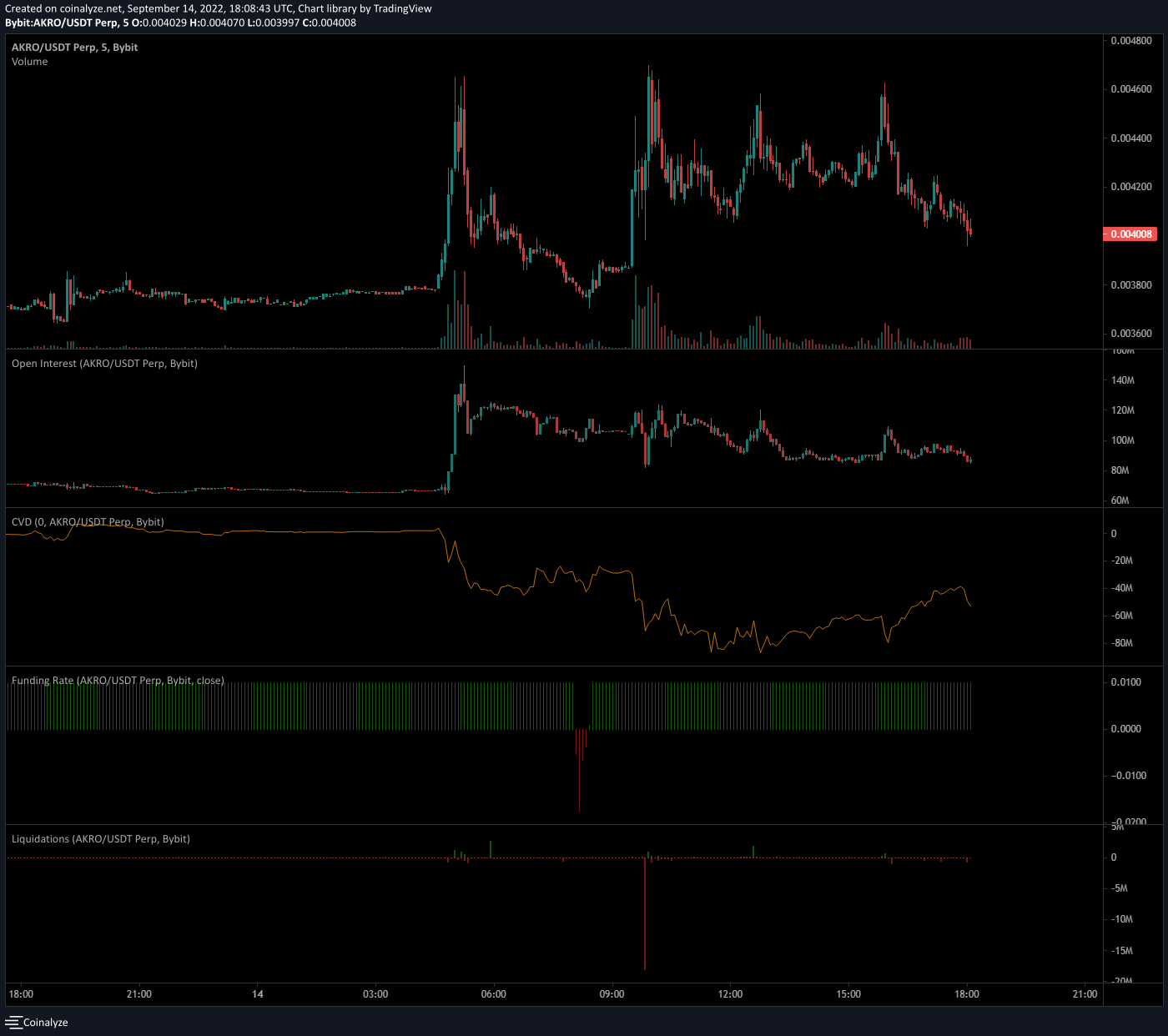

AKRO USDT

Very similar to CKB. Massive amount of volatility, pump then dump, then pump then dump. Currently AKRO is back at support, however again like CKB there was a sideways period of distribution at today's Point of Control. Watch that level for resistance, as investors who bought that level look to get out at cost basis. However, we can likely expect that price will attempt to meander back up that way if the rest of the market shows recovery today. Again, if you swing at this, reduce risk to no more than 1%.

LTF analysis reveals that Open Interest is relatively stagnant, however CVD was on the rise upwards. Funding was also positive, so traders jockeying for long positions. We also just had some long liquidations, so this might be good, but again please be careful this thing is hot.

Summary:

As we all recover from yesterday's dump, we are heartened by taking the entire macroeconomic view into perspective. Although things are not great, they're not completely terrible and we have lots of positive signs. Whether the markets continue to march upwards, or we stagnate sideways for a while remains to be seen, however as we creep closer to next week's FOMC meeting one thing is certain: the volatility is heating up.

If you'd like to learn how to keep yourself cool with volatility heating up, there's no better place to learn and grow than in the Cracking Cryptocurrency Premium Trading Group!

Receive daily Trading Signals, Market Analysis, Insights from our team of Junior and Senior Analysts!

Learn to trade in our Online Trading Academy, utilize our proprietary suite of Premium Indicators, take part in our Community Mentoring Program, and much more!

To start your journey on the Pathway to Profit, find the plan the meets your budget today!