Features & Functions

Multiple Time Frames Feature: With this feature, you can view the Ichimoku of a different time frame than you are currently viewing. This is very useful for looking at daily support and resistance (Kumo, Chikou) but wishing to trade a different strategy (Price Action, Moving Averages, etc.) on a lower time frame.

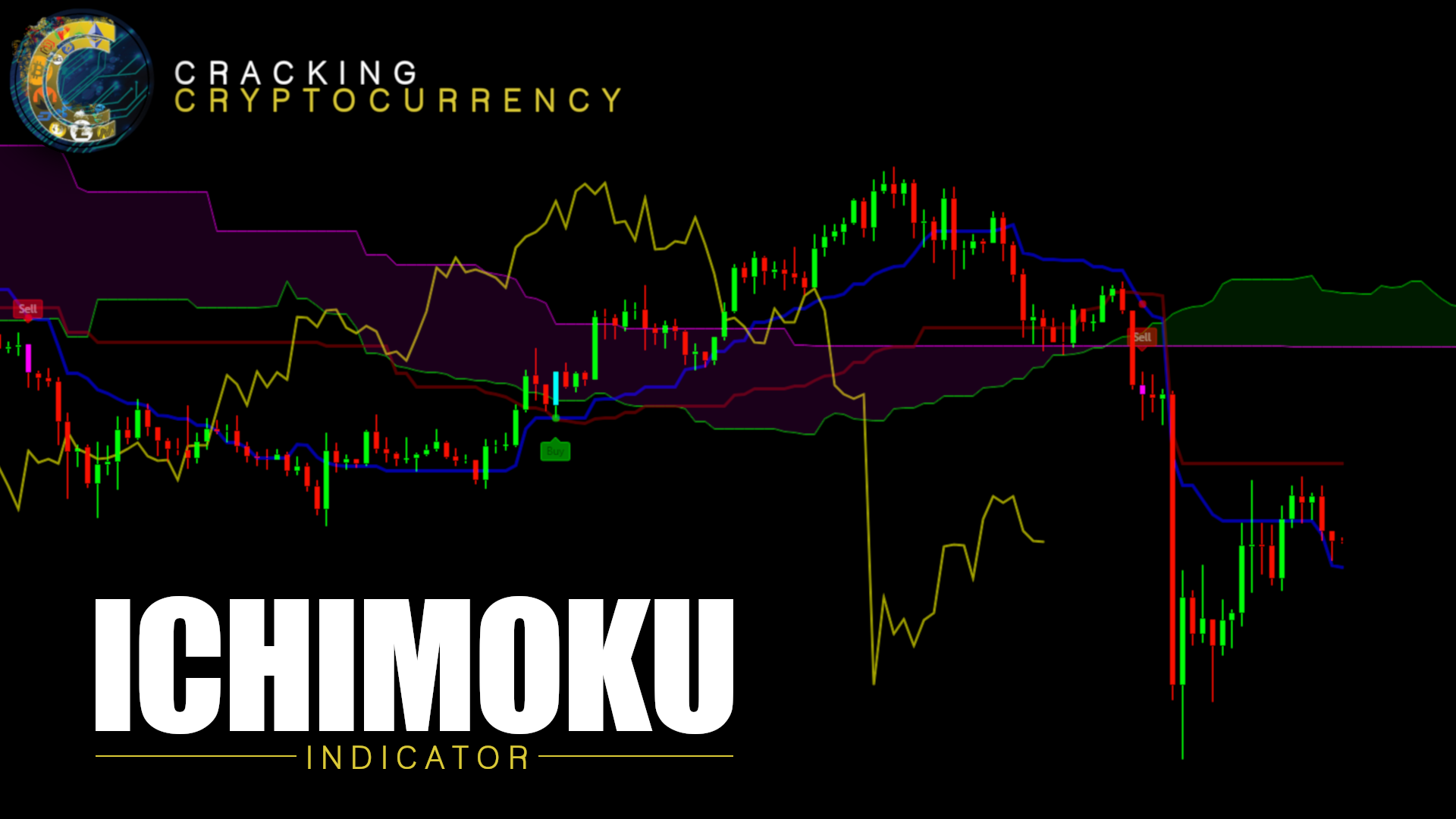

The Ichimoku Cloud is designed to measure both momentum and trend. This script is optimized for **Cryptocurrency** by default but the settings can easily be adjusted from the Input Window to trade on any asset.

The core of the Ichimoku Strategy can be broken down into two facets, depending on whether you prefer to trade short-term or long-term. The Ichimoku is a trending indicator by default, it will not catch bottoms or tops. It is a momentum indicator.

Short-Term Strategy:

Revolves around Tenkan and Kijun crosses. Should the Tenkan crossover the Kijun, that is a bullish indication, and a signal to buy or go long.

Conversely, should the Tenkan crossunder the Kijun that is a bearish indication, and a signal to sell or go short.

In the settings, you can choose to plot Tenkan/Kijun crosses. With this option selected, several things will occur when Tenkan/Kijun crosses happen.

- The current bar will change colors depending on whether the signal is a buy or a sell. Buy = Aqua, Sell = Fuchsia

- A dot will appear on the Tenkan. Buy = Green, Sell = Red

- A label will appear above or below bar indicating the correct decision. Buy = Buy, Sell = Sell.

Long-Term Strategy:

Revolves around price closing above or below the Kumo Cloud itself. Should price close above a bearish Kumo Cloud, that is a bullish indication, and a signal to buy or go long.

Conversely, should price close below a bullish Kumo Cloud, that is a bearish indication, and a signal to sell or go short.

In either case, it's important to understand what the cloud breaks are representing. They are representing a potential shift in the dominant trend. Ichimoku attempts to identify when that shift happens, so we can get on the side of the emerging trend.

In the settings, you can choose to plot Kumo Cloud Breaks. With this option selected, several things will occur when Kumo Cloud breaks happen.

- The current bar will change colors depending on whether the signal was a buy or a sell. Buy = Aqua, Sell = Fuchsia

- A label will appear above or below bar indicating the correct decision. Buy = Buy, Sell = Sell.

Please note, that the Kumo Cloud Breaks indicate stronger signals, and thus more weight should be given to them than TK Crosses. However, depending on what time frame you are trading on, Kumo Cloud breaks are a rarer occurrence than TK Crosses.

Additional Features

The Chikou (Lagging) Spam is run through a Zero Lag filter. The reason for this is aesthetic. The smoothing can be disabled in the input windows.

The purpose of the Chikou Span is to identify Support and Resistance.

If you have any questions, success or failure stories, or seek advice, please let us know!