Market Update & Insights 02-20-19: ADA/USDT, TRX/USDT, LTC/USDT, ADA/USDT, & BTT/USDT

Justin W. 11:38 AM

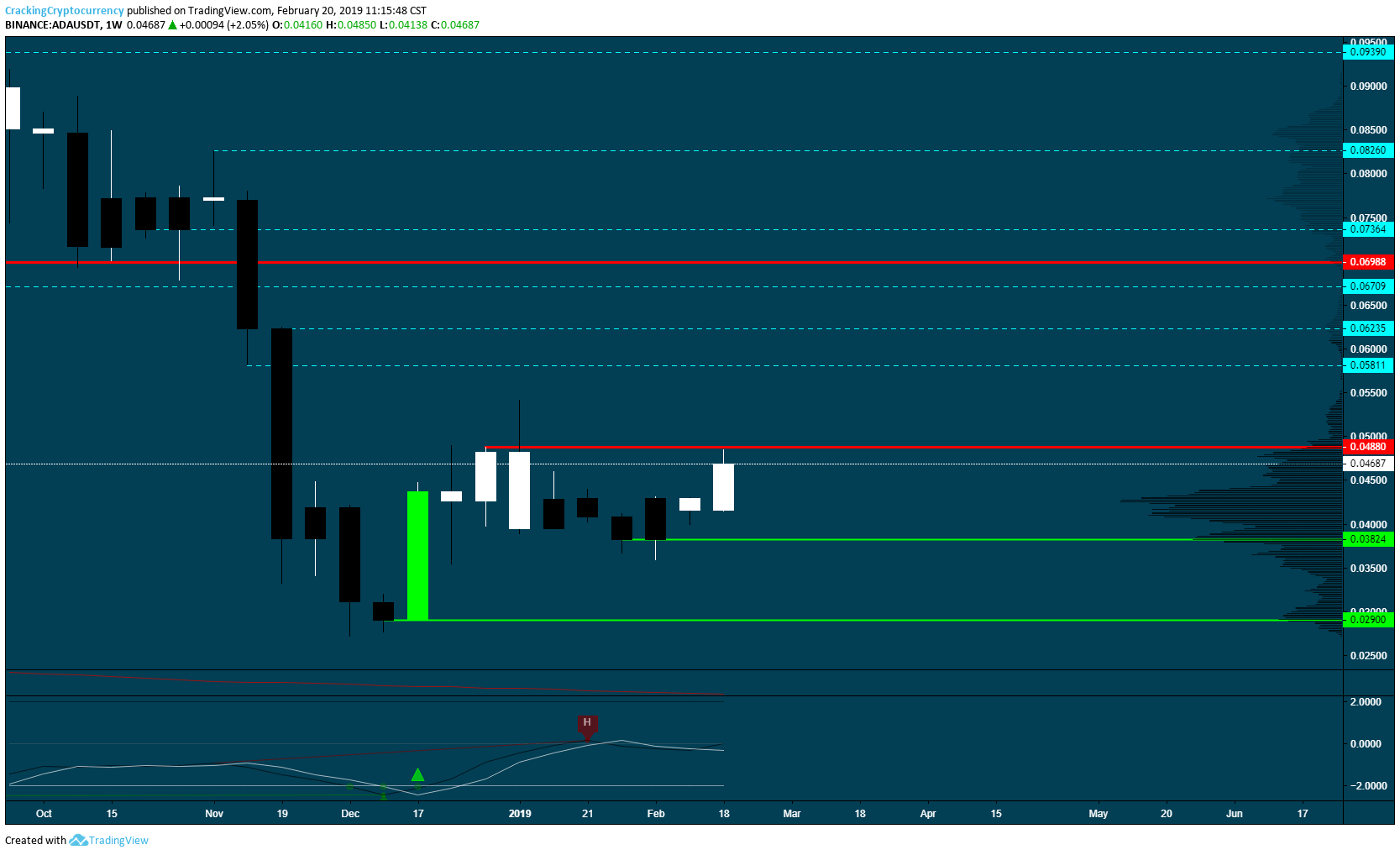

ADA/USDT Weekly

Similar to many altcoins, we are on the verge of a potential alt-season. We are also on the verge of a potential massive rejection from resistance. Patience is needed. If ADA can close above resistance then we could see a pretty smooth move to 7 cents.

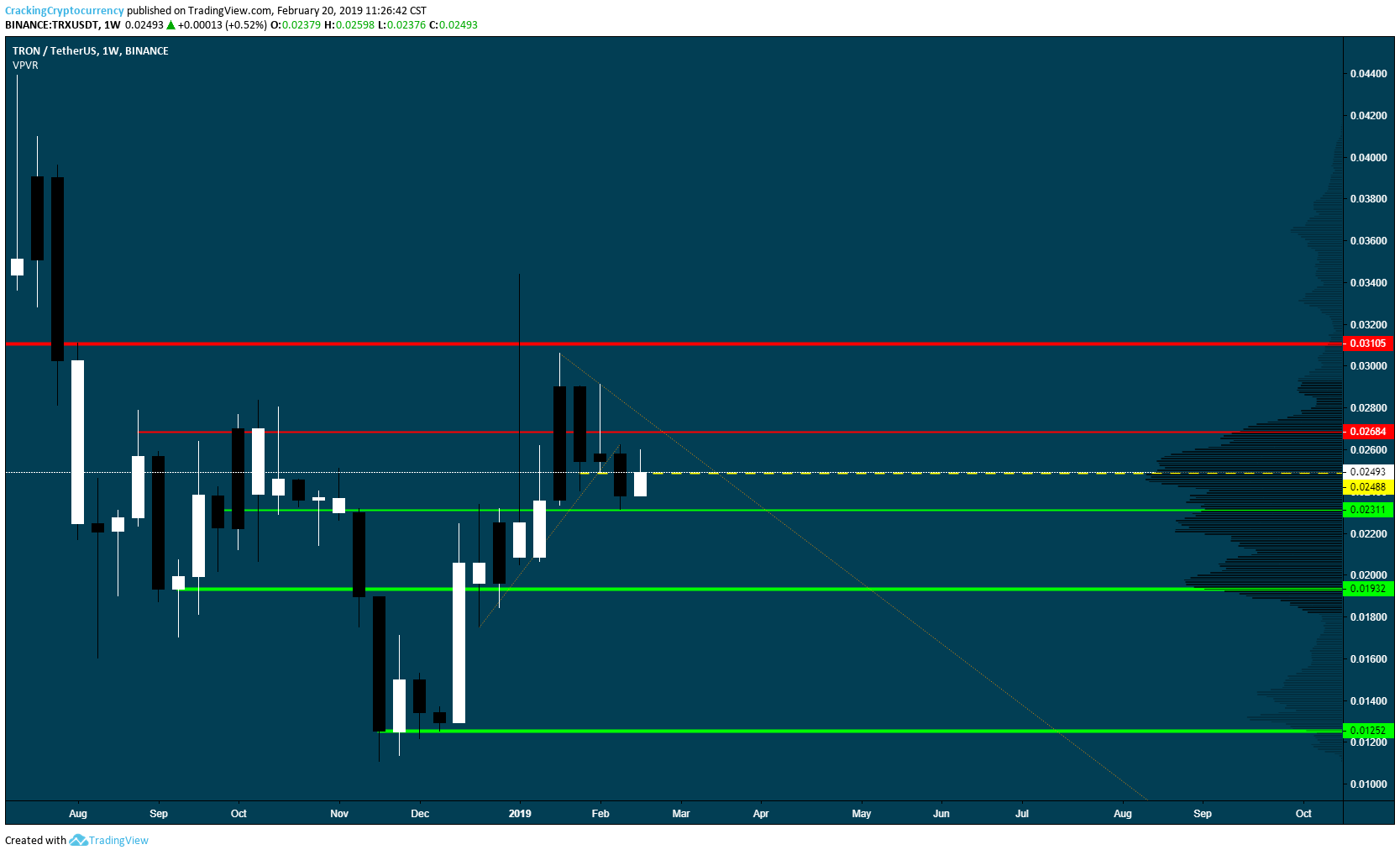

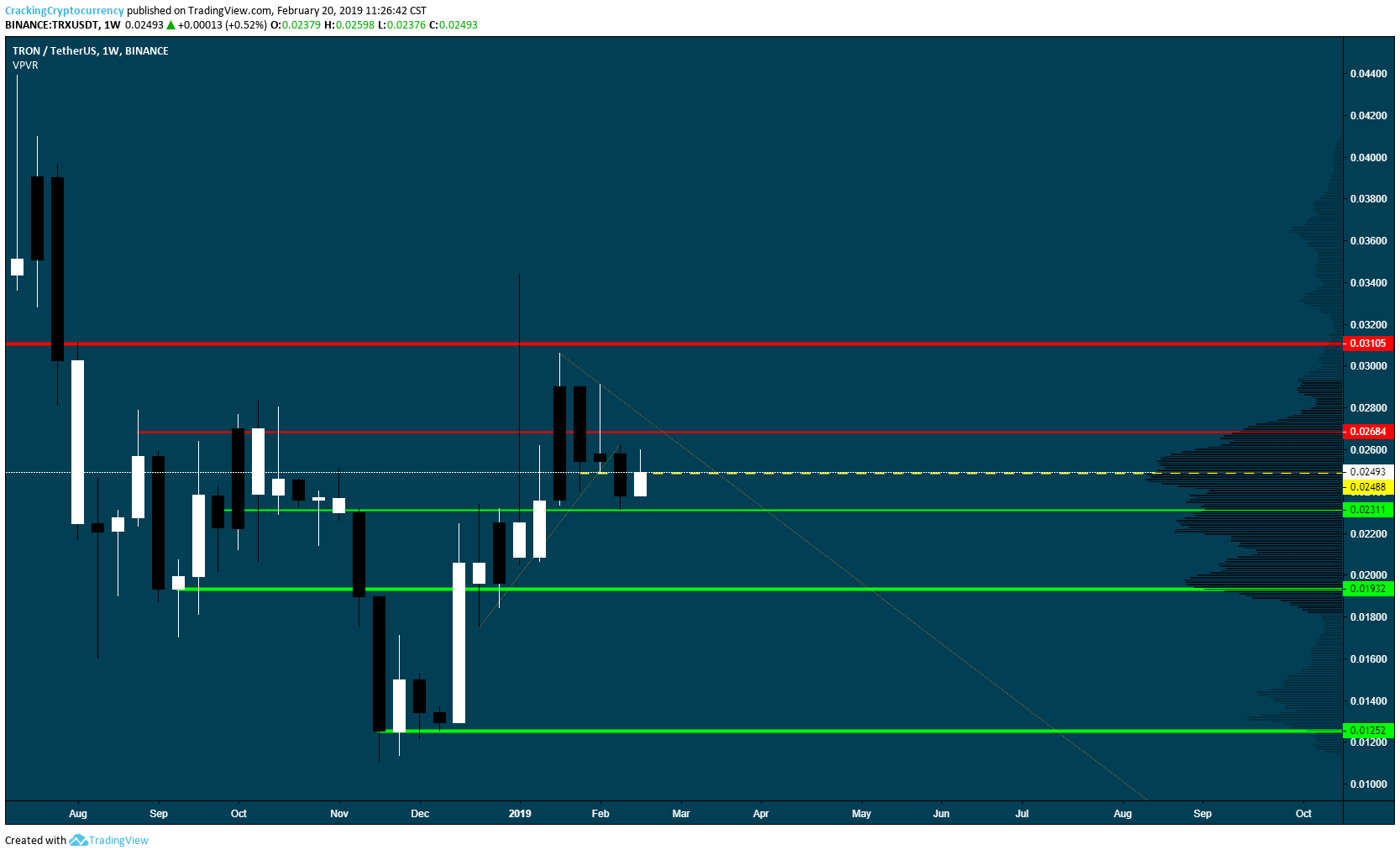

TRX/USDT Weekly

Does not look fantastic. Rally to the proximity of resistance, then a weekly close below the ascending trend line. We've formed a daily breaker (yellow dashed line) but we're struggling to get back above it. This is potentially classic S/R flip rejection.

Justin W. 09:03 PM

LTC/USDT 8HR TradingView Idea

-Price is too close to resistance for me to be an interested buyer.

-A break of 54.79 with a convincing re-claim would make me a buyer.

-Very likely upside targets from that price level.

-The Risk to Reward is not worth a trade to the upside on this time frame.

-Likely supports at 49 and 47.21.

https://www.tradingview.com/chart/LTCUSDT/SAaS40HQ-LTC-USDT-8HR-Analysis/

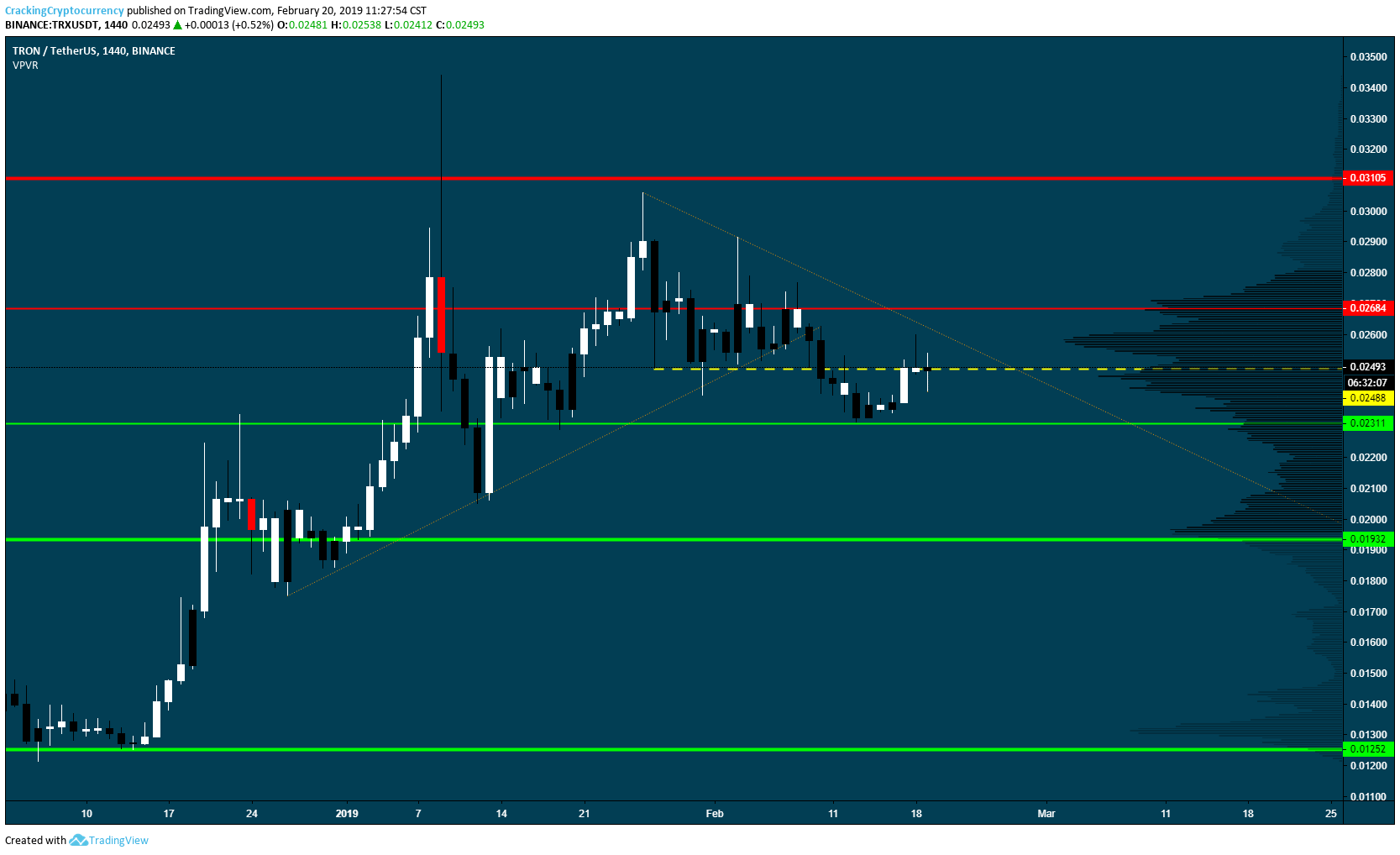

TRX/USDT Weekly

Does not look fantastic. Rally to the proximity of resistance, then a weekly close below the ascending trend line. We've formed a daily breaker (yellow dashed line) but we're struggling to get back above it. This is potentially classic S/R flip rejection.

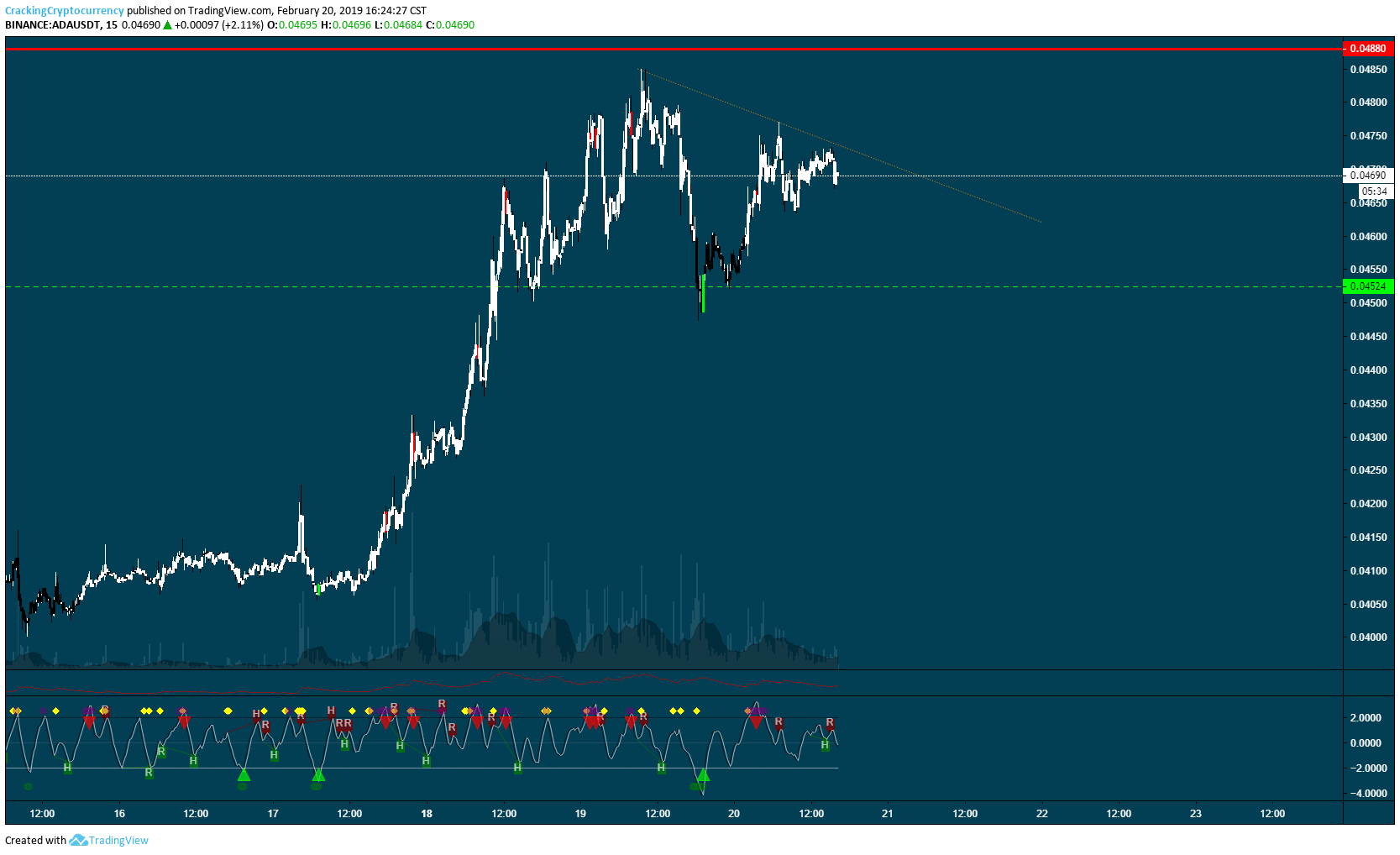

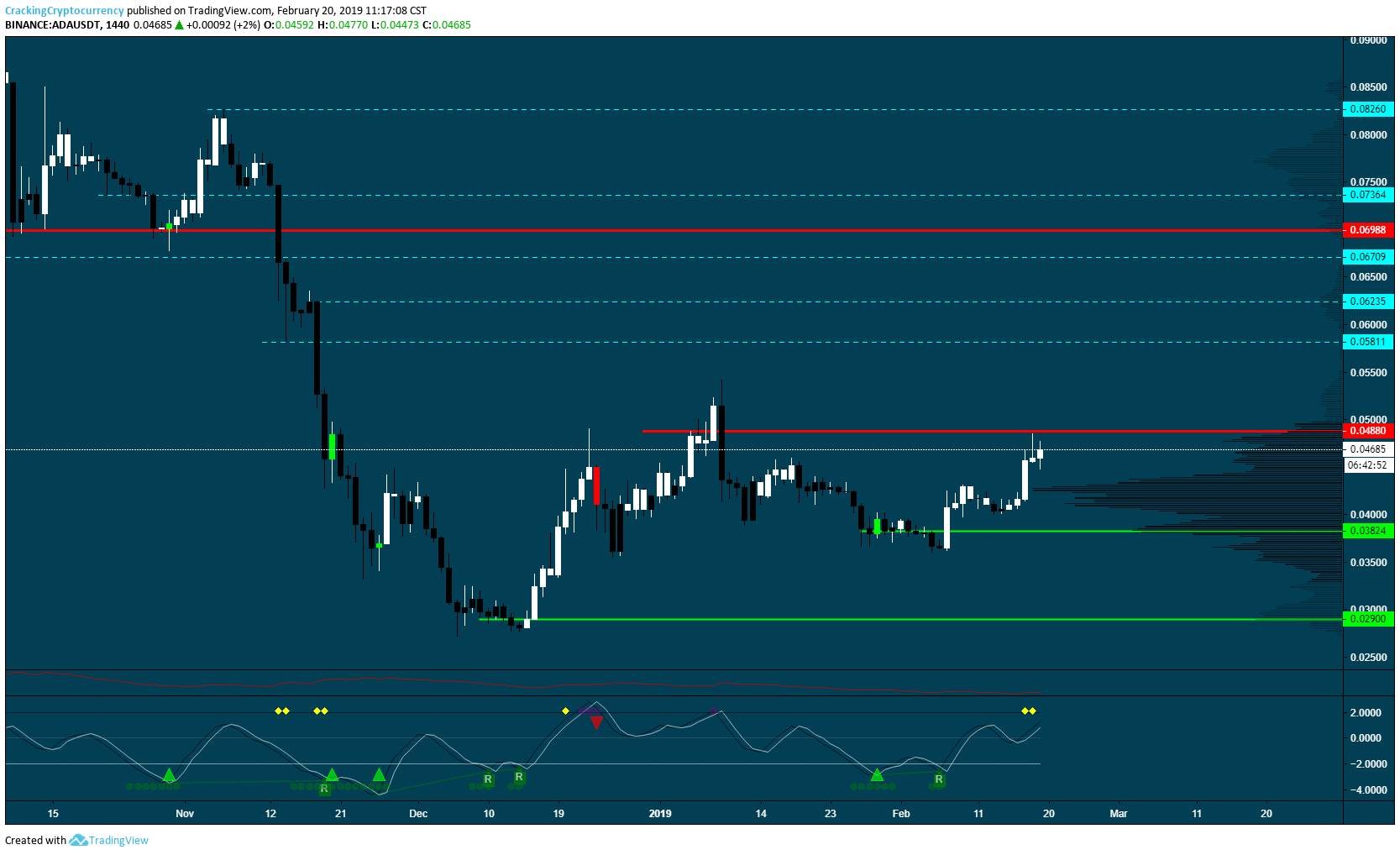

ADA/USDT

Watch price as it approaches this intra-day support. Should bounce back to the descending trend line.

TRX/USDT 8HR TradingView Idea

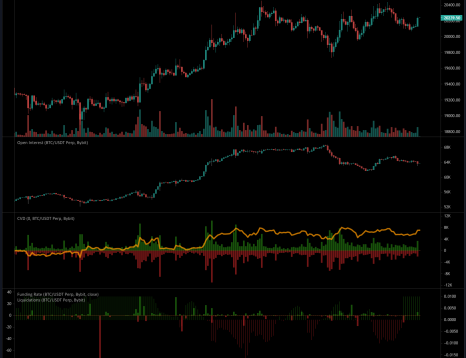

-Price is at an indecision point, denoted by the yellow dashed line.

-Falling volume in a downtrend, I do not believe we have tapped into enough liquidity to change the dominant trend.

-Am more interested in looking for selling opportunities.

-Should price re-test the local high near 0.026 I will look for entry opportunities.

-Ranging price action for the next two days I believe. 8HR Ichimoku we rejected from the Kijun and found support on the Tenkan.

-Lagging span within price indicates a likely range between these two extremes until one is broken.

-All our moving averages are sideways, indicating a stall in price direction. Consolidation at these levels is likely.

-Our best option becomes lower time frame range trades at this point.

BTT/USDT 3HR TradingView idea

-Symmetrical pattern forming across all time frames.

-Approaching the lower bounds of that pattern.

-Potential Entries would be recovery from oversold conditions near support, or the breakout to the upside of the pattern.

-Cyan lines within the triangle itself are shorter-term profit targets for the oversold recovery trade.

-Cyan lines above the triangle represent longer-term profit targets for either entry

https://www.tradingview.com/chart/BTTUSDT/j2QWoDvi-BTT-USDT-3HR-Analysis/