Forbes: ‘Bitcoin Is The New Gold’, Crypto Winter Is Over

Forbes has recently ran a headline declaring that Bitcoin is "the new gold" and that crypto winter has come to an end as a bullish technical set up takes hold.

The headline ran by the top financial publication is further indication that mainstream press and their analysts are dropping the "bitcoin is dead" narrative and replacing it with a rather bullish outlook.

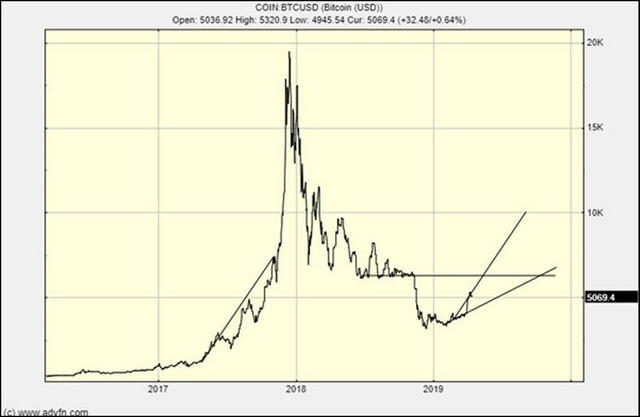

In the article, Forbes contributor and CEO of stocks and investment website ADVFN, Clem Chambers, says after calling the lows of Bitcoin around the $2,500 level, he is now ready to see BTC shoot up to $10,000 as it appears the long term downtrend has reversed, for now.

Chambers writes:

All last year I was saying, “It’s going down, hopefully to about $2,500.” It hit the low $3,000s.

Now bitcoin is going up and I will be saying “It’s going up.” I think it will hit $6,000 soon and go on to $10,000.

At $10,000 I will look to recalibrate.

He would add:

For now the crypto winter is over.

According to Chambers, this chart provides all the reasoning he needs to believe that the price of BTC is going higher:

Bitcoin and Gold

As many in the crypto space believe that bitcoin is indeed as good as gold, with the enormous amounts of CPU power needed to bring new coins into existence - much like mining gold - the idea that BTC can act as a similar store of value may be becoming more popular.

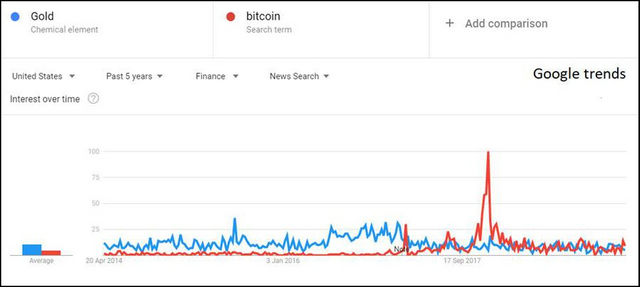

In his article, Clemens points out that the "mindshare" of interest in financial news is pointing out that bitcoin is potentially digging into the interest in gold.

Citing Google trends, he writes that, "you can see what looks like bitcoin eating into the interest in gold, at least in the U.S."

Clemens also points out that interest in gold is driven by countries with low tech penetration, suggesting that over time bitcoin "will increasingly share the flight capital/risk asset crown with gold," assuming that the right technology will eventually penetrate these areas.

Media Goes Full Bull

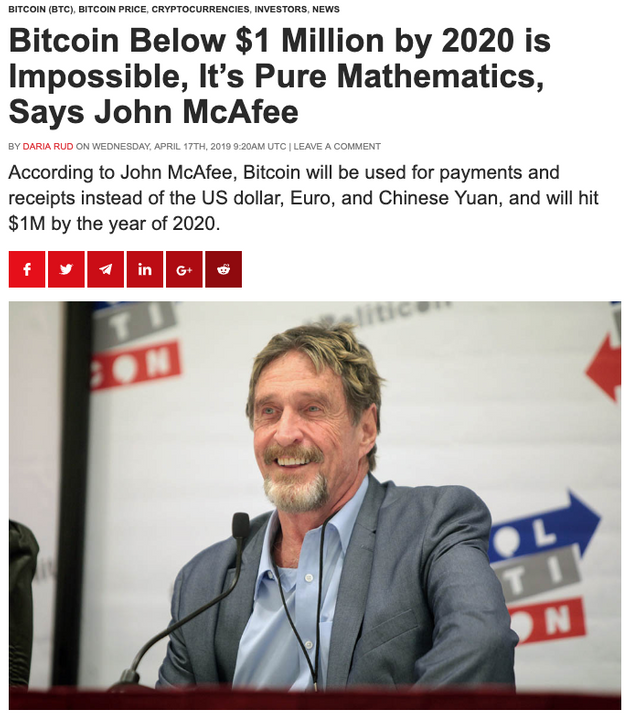

When mainstream media outlets start to follow the bullishness now penetrating much of the Bitcoin news space, there are a few outcomes that can result. The most obvious one is retail FOMO.

It takes one good look at the online Bitcoin/crypto press to understand where everyone's mind is at as far as bitcoin's (and the crypto market as a whole) price are, for example:

And the line CNBC has been touting lately about the worlds largest crypto, runs right in path with the bulls:

All of this begs the question: When and if bitcoin continuously strikes new highs as a part of a renewed bull run, how much FOMO will be ignited by the news media's fixation on huge price predictions?