Bitcoin Pumps From Demand – But Is It Enough?

Breaking Bitcoin Market Update

August 31, 2011

The cryptocurrency markets are surging over the last 24 hours. It seems the significant demand zone that the decline of Bitcoin reached was sufficient for short-term investors/traders to feel some hunger pains and get greedy. Bitcoin and Ethereum are up 1% each approximately, and altcoins have pushed up strongly with notable gainers LUNC, KAVA, LDO, NEXO, and NEAR.

With Fall right around the corner, I'm amazed at how similar the current market structure, feel, and dynamics are similar to those of the late stage 2018 bear market. If you'll recall, in 2018 we descended from our lofty heights of $19,000 before consolidating around $6,000 for the majority of the year.

As we crept into Fall 2018 however, volatility and demand completely dried up and you were lucky to get a 3% day out of the world's most volatile asset. Then, on the eve of that fateful November night, Bitcoin broke support and began it's nosedive to $3k, which marked the bottom of the bear market, the full turning of the wheel, and the begin of an 18 month accumulation period that gave birth to the 2020 and 2021 bull cycle.

The wheel turns, and what was will be once again. Although history doesn't repeat, it does rhyme. With the on-chain metrics for Bitcoin illuminating the fact that demand is barely able to keep pace with day to day selling, we find ourselves in a dangerous environment. While long-term holders are not moving or spending their coins, short-term traders are taking advantage of any exit liquidity they can to get out at or around their cost basis.

If we have a bearish catalyst, where positioned buyers become forced sellers, we will experience another capitulation event that can easily send Bitcoin's price down to our predicted price target of $14,000. This is based on a combination of on-chain and technical analysis, with the advent of the Valuation Model: Bitcoin's Delta Price.

Is this the time to be filling your bags with these discount cryptocurrency prices? I do not believe so. If Bitcoin gets hammered another 30-40%, then altcoins will feel the pain to the tune of 50-70%. What seems cheap right now, is only relatively cheap. Patience is still required, and one must keep an eye toward the macro bigger picture.

Below, in today's Market Analysis we will cover on-chain metrics, technical analysis, fundamentals, and cover portfolio and trade recommendations. Thank you for your continued support, and as always: trade safely.

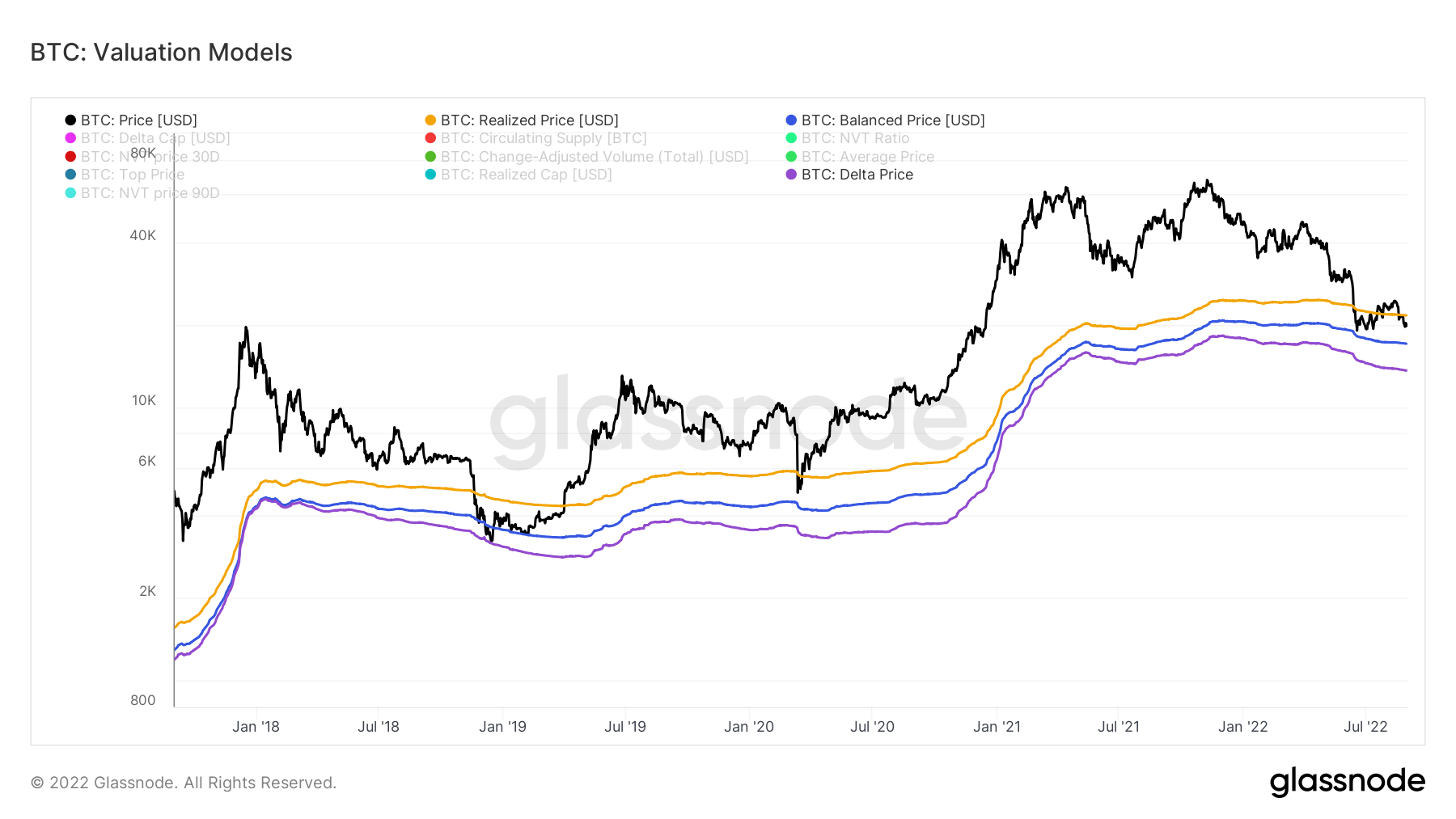

Bitcoin Valuation Models:

After rallying briefly above it's Realized Price metric, Bitcoin is now trading firmly below it. We have yet to establish a macro lower low, so it is plausible that Bitcoin has/is close to bottoming and is forming a long-term consolidation pattern. However, prepare for the worst and expect the best as they say.

Our two lower price targets have evolved, with Bitcoin's Balanced Price resting at $17,059.50 and our ultimate price target, Bitcoin's Delta Price, resting at $13,612.54.

Bitcoin Net Realized Profit/Loss (90DMA)

During Bitcoin's recent rally, Bitcoin investors were locking in significantly lower losses than they were during the local bottom. However, it is still a fact that on average all sellers selling at these price levels are locking in losses. On average, Bitcoin investors are locking in $220 million dollar worth of loss per day.

Historically, that number is significant and this year's current bear market is on par with the damage done during previous bear markets, notably 2013 and 2018.

While we did see a brief decline in losses locked, that metric has begun to slide back down again indicating that traders are deeper underwater now then they were several weeks or months ago. While it is possible that this metric has bottomed and is beginning a long-term uptrend, more time is needed.

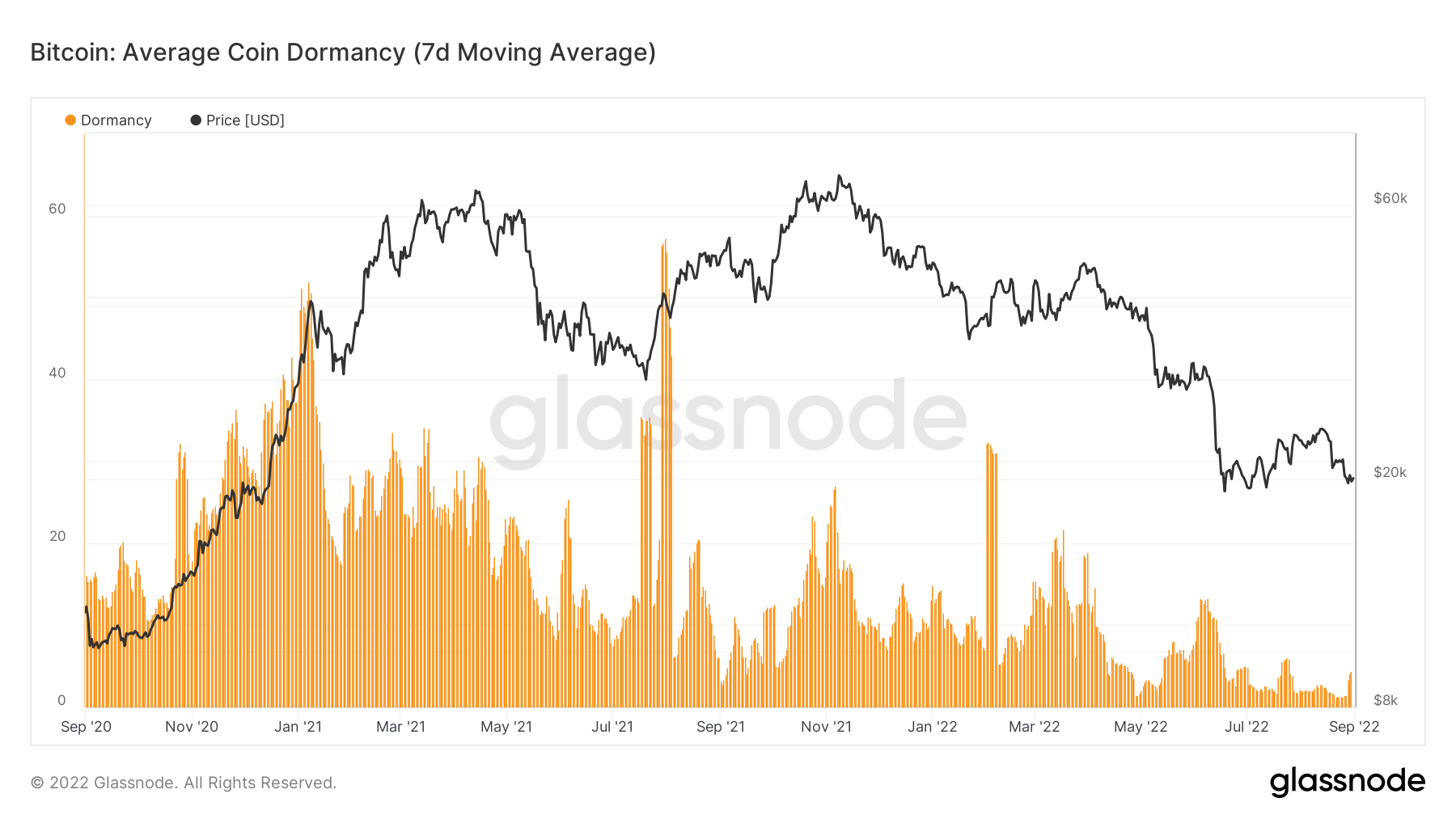

Bitcoin Average Coin Dormancy (7DMA)

Dormancy tracks the average age of Bitcoin moved on-chain. We can see that this metric has been in decline since January 2021. This means that older coins are staying put in their wallets, and that the majority of coins moved on-chain are recently minted Bitcoin.

In a bull market, this is a very positive signal as it shows that older coins are staying put and that long-term investors are not selling. However, currently the reverse is true. Prices are declining even though long-term investors are sitting tight. This futher strengthens our argument that current demand is barely able to prop up the price of Bitcoin at these levels.

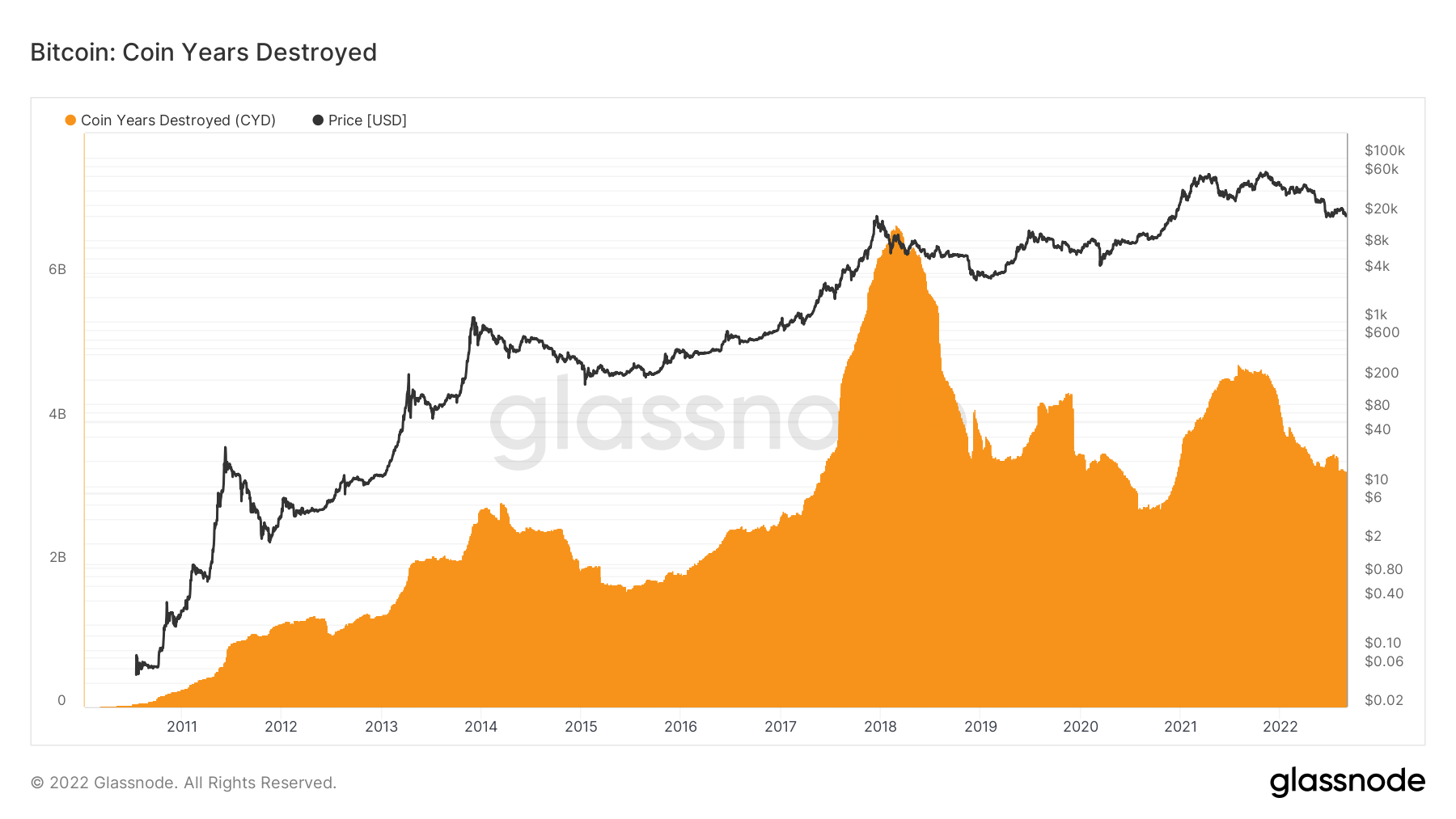

Bitcoin: Supply-Adjusted Coin Years Destroyed

This metric tracks the yearly sum of Coin Days Destroyed, a metric first put forward by Ark Invest. This tracks the destruction of Coin Days, essentially how long it has been since a coin has been moved. If a coin has been sitting in a wallet for a long time, and then is spent (sent on the network) that is considered a destruction of Coin Days. This metric helps us see long-term holder behavior and investor sentiment.

Note that during late stage bear markets/early bulls, this metric drops to it's lows. You can see this between 2015-2016, 2018-2019, and finally 2020-2021.

We are currently in a decline on this metric, and getting close to the lows put in during the last late stage bear market. Again, Bitcoin may have bottomed and is entering into it's accumulation phase, however we are not out of the woods yet.

Altcoins of Interest: Strong and Oversold

Here we track the top ten altcoins of buying interest based on the metrics of having an MVRV score placing them in oversold territory, while also having strong on-chain demand and network activity.

#1 Dogecoin (DOGE)

#2 HEX (HEX)

#3 Uniswap (UNI)

#4 ApeCoin (APE)

#5 Decentraland (MANA)

#6 The Sandbox (SAND)

#7 Quant (QNT)

#8 Stepn (GMT)

#9 Trust Wallet Token (TWT)

#10 Gala (GALA)

Altcoins of Interest: Exchange Inflow Anomalies

Here we track the top ten altcoins of selling interest based on the metrics of large inflows to exchanges.

#1 Uniswap (UNI)

#2 ChainLink (LINK)

#3 OKB (OKB)

#4 Nexo (NEXO)

#5 1inch (1INCH)

#6 Machine Xchange Coin (MXC)

#7 Liquity USD (LUSD)

#8 SKALE Network (SKALE)

#9 DAO Maker (DAO)

#10 SSV Network (SSV)

Altcoins of Interest: Strong Activity

Here we track the top ten altcoins of buying/selling interest based on a significant uptick of on-chain and exchange volume and daily active addresses.

#1 Machine Xchange Coin (MXC)

#2 Braintrust (BTRST)

#3 MX Token (MX)

#4 AdEx (ADX)

#5 SOLVE (SOLVE)

#6 Leage of Kingdoms Arena (LOKA)

#7 Numbers Protocol (NUM)

#8 OAX (OAX)

#9 Razor Network (RAZOR)

#10 Unification (UND)

MXC - Notable accumulation is seen here with the spike in Daily Active Addresses. However, this coin has just pumped and is experience a large influx of exchange volume at a local high. This is likely a sell signal.

BTRST - Significant spike of DAA and volume on the recent price spike. Not currently seeing significant enough values to warrant action.

ADX - Recent spike correlating with a sell off. Avoid.

SOLVE - Recent spike at a peak price. Sell signal.

LOKA - Potential re-accumulation for another pump. Keep your eye on it.

NUM - Sort of looks promising, but we need to see another uptick in DAA to be viable otherwise price will decline.

OAX - Sell signal.

UND - Massive spike in all metrics and this thing has been pumping. Immediate sell signal.

Altcoin Summary:

NUM, LOKA, and MX Token are really the only ones that seem to have potential, all the other altcoins above are immediate or pending sells. Assess your portfolio for these coins. Larger projects like DOGE, HEX, APE, and MANA might be worth taking a closer look at if prices climb higher going into next week.

That's a wrap folks. Remember, risk management and emotional discipline are the most important tools for a trader and investor to have, ignore them at your peril. If you found this content useful, please share a link to today's market analysis on your social media and comment down below your thoughts, positions, and opinions.

Did you know that in addition to Market Analysis and Trading, our primary occupation is educating traders?

If you are tired of navigating the markets alone and desire a streamlined and dedicated approach to your trading education, join our Premium Trading Group!

This will give you access to our Online Trading Academy, where with our Pathways to Profit system you will learn to build your own objective and comprehensive trading system from the ground up!

In addition, enjoy Trading and Investment Signals, Mentoring, Premium Trading Indicators, Automated Strategies, and a private community dedicated to your success. Find the plan that fits your budget by clicking here!

![Machine Xchange Coin (MXC) [10.55.37, 31 Aug, 2022] Machine Xchange Coin (MXC) [10.55.37, 31 Aug, 2022]](https://crackingcryptocurrency.com/wp-content/uploads/2022/08/Machine-Xchange-Coin-MXC-10.55.37-31-Aug-2022.png)

![Braintrust (BTRST) [10.56.52, 31 Aug, 2022] Braintrust (BTRST) [10.56.52, 31 Aug, 2022]](https://crackingcryptocurrency.com/wp-content/uploads/2022/08/Braintrust-BTRST-10.56.52-31-Aug-2022.png)

![AdEx (ADX) [10.57.57, 31 Aug, 2022] AdEx (ADX) [10.57.57, 31 Aug, 2022]](https://crackingcryptocurrency.com/wp-content/uploads/2022/08/AdEx-ADX-10.57.57-31-Aug-2022.png)

![SOLVE (SOLVE) [11.00.33, 31 Aug, 2022] SOLVE (SOLVE) [11.00.33, 31 Aug, 2022]](https://crackingcryptocurrency.com/wp-content/uploads/2022/08/SOLVE-SOLVE-11.00.33-31-Aug-2022.png)

![League of Kingdoms Arena (LOKA) [11.00.52, 31 Aug, 2022] League of Kingdoms Arena (LOKA) [11.00.52, 31 Aug, 2022]](https://crackingcryptocurrency.com/wp-content/uploads/2022/08/League-of-Kingdoms-Arena-LOKA-11.00.52-31-Aug-2022.png)

![Numbers Protocol (NUM) [11.01.35, 31 Aug, 2022] Numbers Protocol (NUM) [11.01.35, 31 Aug, 2022]](https://crackingcryptocurrency.com/wp-content/uploads/2022/08/Numbers-Protocol-NUM-11.01.35-31-Aug-2022.png)

![OAX (OAX) [11.02.15, 31 Aug, 2022] OAX (OAX) [11.02.15, 31 Aug, 2022]](https://crackingcryptocurrency.com/wp-content/uploads/2022/08/OAX-OAX-11.02.15-31-Aug-2022.png)

![Unification (UND) [11.02.59, 31 Aug, 2022] Unification (UND) [11.02.59, 31 Aug, 2022]](https://crackingcryptocurrency.com/wp-content/uploads/2022/08/Unification-UND-11.02.59-31-Aug-2022.png)